Carter Quantitative Estimation the Forex market Buying and selling Technique

Buying and selling isn’t a very simple enterprise. Consider expecting value actions of a tradeable safety when if truth be told it’s depending on plenty of components and the whims of 1000’s of investors world wide. the Forex market buying and selling specifically is much more tricky. The sheer dimension of the marketplace implies that there are extra marketplace members who’ve various expectancies and outlooks. This steadily reasons the cost of foreign exchange foreign money pairs to differ unevenly. Upload to it the truth that foreign exchange pairs are composed of 2 currencies, that are themselves particular person tradeable commodities with other provide and insist buildings.

Even if foreign currency trading isn’t simple, investors who grasp it give you the chance to make limitless cash from the foreign exchange marketplace. The similar volatility that may purpose some investors to lose some cash is similar explanation why there’s such a lot alternative in buying and selling the foreign exchange marketplace.

Skilled investors generate income from buying and selling the foreign exchange marketplace as a result of they’ve an edge. A buying and selling edge is a bonus that investors have that are supposed to let them have upper win percentages or upper risk-reward ratios or a mix of each, which will have to lead to a persistently successful buying and selling statistic.

One of the vital highest resources of a buying and selling edge are technical signs. No longer all technical signs are made the similar. Some are higher than others. Technical signs typically assist investors establish alternatives available in the market that have a prime win likelihood. Alternatively, they will have to now not be used as the one foundation to make a business. Investors will have to in finding confluences in accordance with other rationales, whether or not or not it’s from value motion or confluences with different technical signs.

Carter MA

Carter MA is a straightforward pattern following technical indicator which is in accordance with a collection of changed shifting averages.

Actually, the Carter MA is a collection of shifting averages used to assist investors obviously establish pattern course. What is exclusive concerning the Carter MA is that it considers the long-term pattern, mid-term pattern, non permanent pattern and the speedy momentum impulses of value motion.

The Carter MA consists of 5 shifting reasonable strains with various length lengths to account for the non permanent pattern as much as the long-term pattern.

Development course is known in accordance with how the shifting reasonable strains are stacked. In a bullish trending marketplace, the non permanent shifting reasonable strains are typically stacked above the long-term shifting reasonable strains. Inversely, in a bearish pattern, the non permanent shifting reasonable strains are typically stacked under the long-term shifting reasonable strains.

Shifting reasonable strains that don’t seem to be stacked well may just point out a range-bound marketplace.

Development energy will also be assessed in accordance with the fanning out of the shifting reasonable strains.

Crossovers between the shifting reasonable strains will also be indicative of a likely pattern reversal.

The spaces between the shifting reasonable strains will also be thought to be as a dynamic house of improve or resistance.

Qualitative Quantitative Estimation

Qualitative Quantitative Estimation (QQE) is likely one of the few technical signs which is able to declare to supply a vital spice up in a dealer’s edge if used correctly. Even if it isn’t the “Holy Grail” amongst technical signs, it does produce rather prime most certainly business setups in comparison to maximum technical signs.

The QQE is an oscillator form of technical indicator. It plots two strains which oscillate round 0. The forged blue line is the principle QQE line, whilst the dotted line is a sign line. Sure strains typically point out a bullish pattern bias, whilst unfavourable strains point out a bearish pattern bias.

Momentum will also be known in accordance with how the 2 strains overlap. The forged blue line above the dotted line signifies a bullish momentum, whilst having the cast blue line under the dotted line signifies a bearish momentum. Crossovers between the 2 strains point out a likely non permanent pattern or momentum reversal.

Buying and selling Technique

Carter Quantitative Estimation the Forex market Buying and selling Technique is a straightforward pattern following technique which adheres with the long-term pattern, whilst on the identical time supplies business setups in accordance with non permanent momentum reversals.

Development course is known in accordance with how the Carter MA strains are stacked. Additionally it is showed in accordance with the place value motion is typically situated when it comes to the long-term shifting reasonable strains, in addition to the course of the slope of the long-term shifting reasonable strains. Trades are taken best within the course that clings with the long-term pattern.

Value motion would all the time retrace even on trending markets. This may steadily purpose the non permanent shifting reasonable strains to attract closer to the center strains and from time to time intersect with it. So long as the strains don’t contact the longer-term shifting reasonable strains, the marketplace may just nonetheless be thought to be as a trending marketplace.

Retracements will have to additionally purpose the QQE strains to quickly opposite. Industry setups are brought on once a crossover between the 2 QQE strains happen within the course indicated by way of the Carter MA pattern.

Signs:

Most popular Time Frames: 30-minute, 1-hour, 4-hour and day by day charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York periods

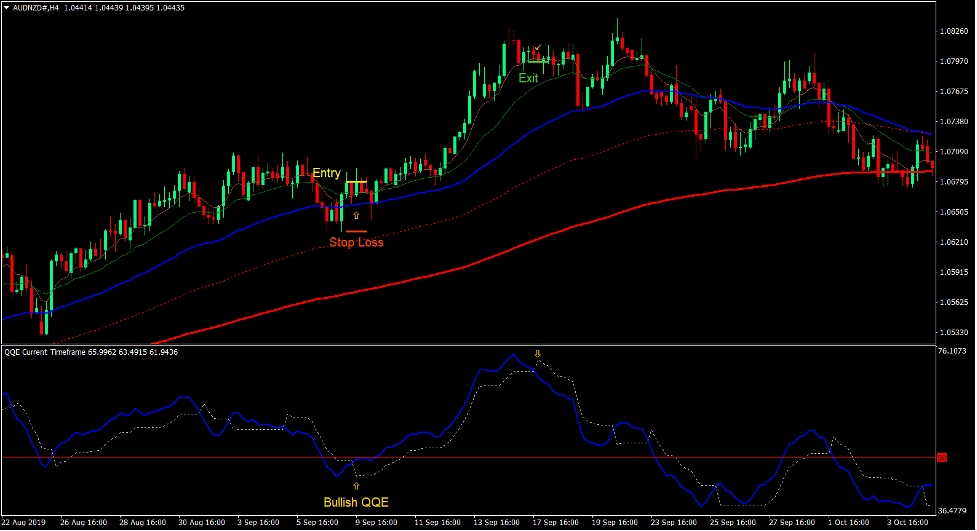

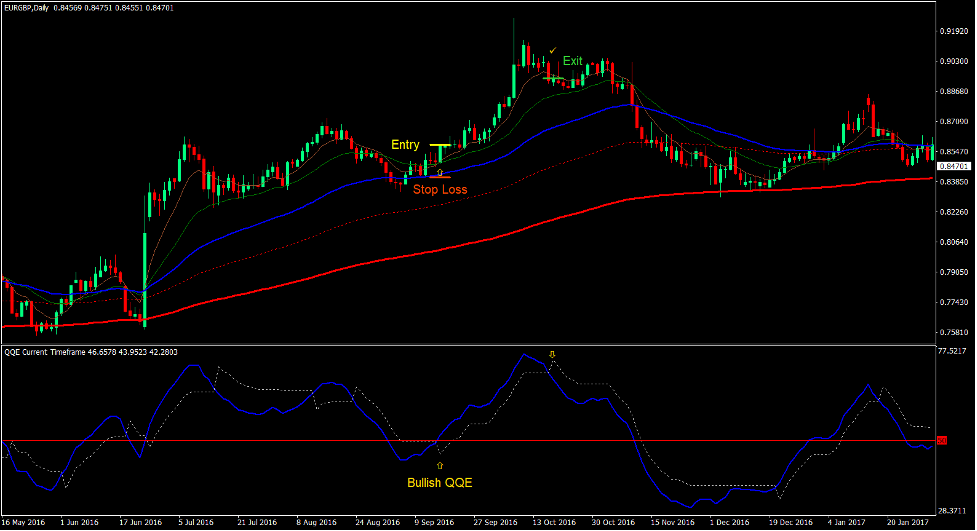

Purchase Industry Setup

Access

- The Carter MA strains will have to be fanning up with the non permanent shifting reasonable strains typically above the long-term shifting reasonable strains.

- Value will have to retrace in opposition to the realm of the blue line.

- Value motion will have to display indicators of bouncing off from the blue line.

- The forged blue line of the QQE indicator will have to pass above the dotted line.

- Input a purchase order at the affirmation of those stipulations.

Forestall Loss

- Set the prevent loss on a improve under the access candle.

Go out

- Shut the business once forged blue QQE line crosses under the dotted line.

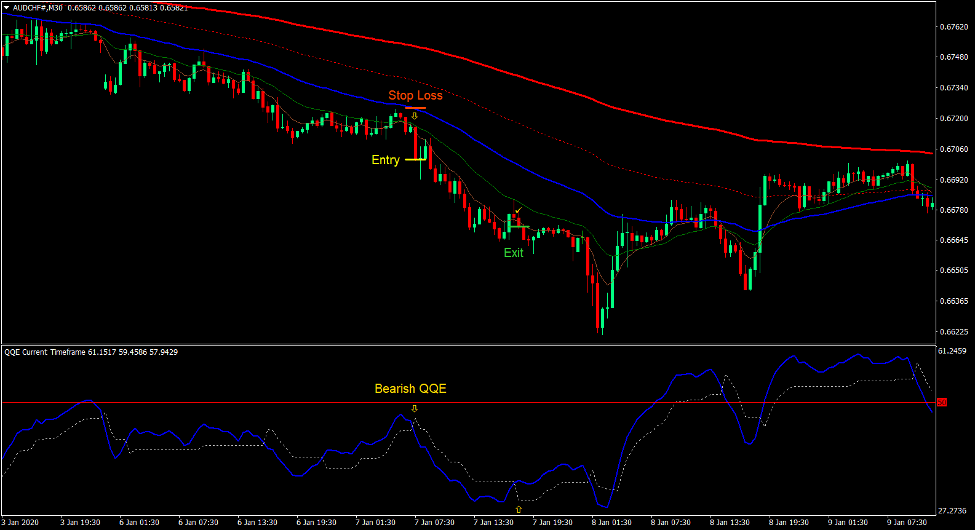

Promote Industry Setup

Access

- The Carter MA strains will have to be fanning down with the non permanent shifting reasonable strains typically under the long-term shifting reasonable strains.

- Value will have to retrace in opposition to the realm of the blue line.

- Value motion will have to display indicators of bouncing off from the blue line.

- The forged blue line of the QQE indicator will have to pass under the dotted line.

- Input a promote order at the affirmation of those stipulations.

Forestall Loss

- Set the prevent loss on a resistance above the access candle.

Go out

- Shut the business once forged blue QQE line crosses above the dotted line.

Conclusion

This easy buying and selling technique is an efficient buying and selling technique which may also be very successful when used as it should be.

Reversal indicators indicated by way of the QQE crossover have a tendency to be very efficient. When traded within the course of the principle pattern, the effects even turn into extra spectacular.

This buying and selling technique when used as it should be with the confluence of value motion indications may end up in an excessively successful business setup.

the Forex market Buying and selling Methods Set up Directions

Carter Quantitative Estimation the Forex market Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to turn out to be the amassed historical past information and buying and selling indicators.

Carter Quantitative Estimation the Forex market Buying and selling Technique supplies a possibility to hit upon quite a lot of peculiarities and patterns in value dynamics that are invisible to the bare eye.

In line with this data, investors can think additional value motion and regulate this technique accordingly.

Really useful the Forex market MetaTrader 4 Buying and selling Platform

- Unfastened $50 To Get started Buying and selling Right away! (Withdrawable Benefit)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable the Forex market Dealer

- Further Unique Bonuses All over The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-Via-Step XM Dealer Account Opening Information

Really useful Choices Buying and selling Platform

- Unfastened +50% Bonus To Get started Buying and selling Right away

- 9.6 General Score!

- Robotically Credited To Your Account

- No Hidden Phrases

- Settle for USA Citizens

Methods to set up Carter Quantitative Estimation the Forex market Buying and selling Technique?

- Obtain Carter Quantitative Estimation the Forex market Buying and selling Technique.zip

- *Reproduction mq4 and ex4 information on your Metatrader Listing / professionals / signs /

- Reproduction tpl record (Template) on your Metatrader Listing / templates /

- Get started or restart your Metatrader Shopper

- Make a choice Chart and Time-frame the place you wish to have to check your foreign exchange technique

- Proper click on for your buying and selling chart and hover on “Template”

- Transfer proper to choose Carter Quantitative Estimation the Forex market Buying and selling Technique

- You are going to see Carter Quantitative Estimation the Forex market Buying and selling Technique is to be had for your Chart

*Be aware: No longer all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Signs from the MetaTrader Platform.