Carter MA Dynamic House Jump the Forex market Buying and selling Technique

Helps and Resistances are key ranges by which investors will have to glance out for. Those are ranges by which value has a tendency to search out it tough to wreck thru.

There are a number of situations which couple of situations which ceaselessly happen on legitimate toughen and resistance spaces. From time to time, value would spoil thru such spaces. This state of affairs is named a momentum breakout situation which will happen as a breakout from a resistance degree or a breakdown from a toughen degree. Continuously occasions, value would jump off those ranges. Worth would ceaselessly opposite go into reverse because it hits a legitimate resistance degree or jump again up because it hits a legitimate toughen degree. There are different situations which might happen reminiscent of a false breakout, by which case value would quickly pierce the toughen or resistance degree as though it might breakout, then opposite simply as a standard jump.

Finally, buying and selling on toughen and resistance spaces can be a legitimate buying and selling technique with an excellent attainable for earnings as a result of the job that in most cases happen on those ranges. The query now could be how do we discover legitimate toughen or resistance ranges?

There are various kinds of helps and resistances. There are the horizontal helps and resistances, which can be like provide and insist zones that experience proven to be revered via value. There also are the diagonal toughen and resistance strains, which can be recognized via connecting swing issues and plotting trendlines.

On this technique on the other hand, we will be able to be having a look at buying and selling bounces off of a dynamic house of toughen or resistance the use of a customized technical indicator.

Dynamic helps and resistances are in most cases recognized in accordance with shifting averages. Those are shifting reasonable strains which value has a tendency to dance off from each and every time it’s revisited.

Carter MA

Carter MA is a customized technical indicator which is in accordance with a collection of changed shifting averages. Buyers ceaselessly use quite a lot of technical averages to constitute the non permanent, mid-term and long-term traits. Carter MA plots a collection of broadly used shifting averages which many investors use a foundation for making their industry selections.

Carter MA plots 5 shifting reasonable strains with shifting reasonable classes as follows: 8, 21, 50, 100 and 200.

Buyers can use those strains to spot the overall course of the fashion in accordance with how those shifting reasonable strains are stacked.

Buyers too can the spaces in between or close to the strains to spot dynamic spaces of helps and resistances the place value generally tend to dance off from.

Relative Energy Index

The Relative Energy Index (RSI) is a broadly used momentum indicator which is an oscillator form of technical indicator. It identifies momentum in accordance with an underlying computation of ancient value actions.

The RSI plots a line that oscillates throughout the vary of 0 to 100 with a mean at degree 50. An RSI line above 50 in most cases signifies a bullish development bias, whilst an RSI line beneath 50 signifies a bearish development bias.

It additionally usually has markers at degree 30 and 70. Imply reversal investors establish an RSI line beneath 30 as an oversold marketplace, whilst an RSI line above 70 signifies an overbought marketplace. Each stipulations are high for imply reversal situations.

Momentum investors alternatively may just establish breaches of those ranges as a sign of sturdy momentum. All of it boils all the way down to how value motion is behaving because the RSI line reaches those ranges.

Many investors additionally upload the degrees 45 and 55 to help them in figuring out traits. Degree 45 acts as a toughen for the RSI line in a bullish trending marketplace, whilst degree 55 acts as a resistance for the RSI line in a bearish trending marketplace.

Buying and selling Technique

Carter MA Dynamic House Jump the Forex market Buying and selling Technique is an easy development following technique in accordance with the idea that of bounces off dynamic toughen and resistance ranges.

The dynamic toughen and resistance ranges are in accordance with the Carter MA strains. The spaces adjoining to the blue shifting reasonable line acts because the dynamic spaces of toughen or resistance. You will need to be aware that value motion will have to have in the past revered the world as toughen or resistance to be a legitimate dynamic toughen or resistance the following time value revisits the extent.

The RSI line acts as a affirmation of the fashion. The RSI line will have to recognize ranges 45 and 55 as toughen or resistance ranges.

Industry indicators are legitimate as value closes again outdoor the golf green line and the RSI line breaks out of ranges 45 or 55 within the course of the fashion.

Signs:

- Carter_MA

- Relative Energy Index

Most popular Time Frames: 1-hour, 4-hour and day by day charts

Foreign money Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York periods

Purchase Industry Setup

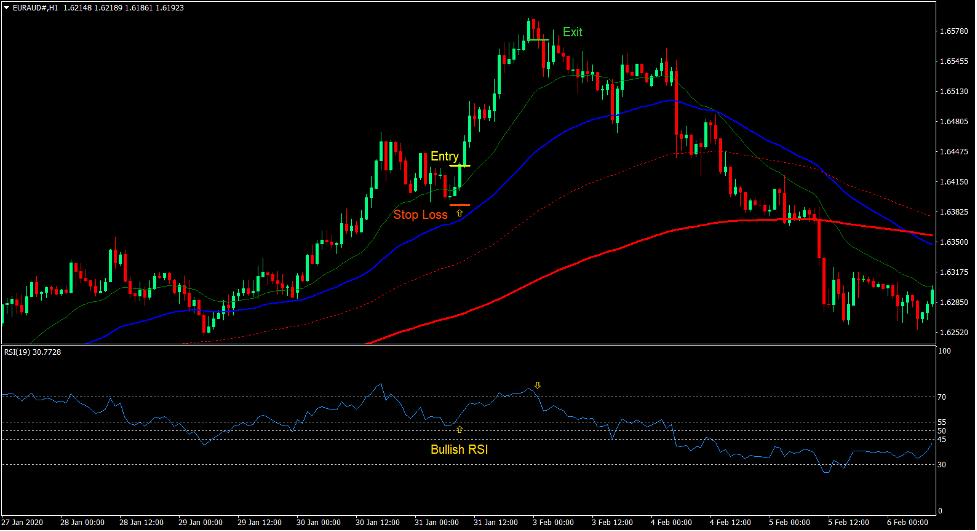

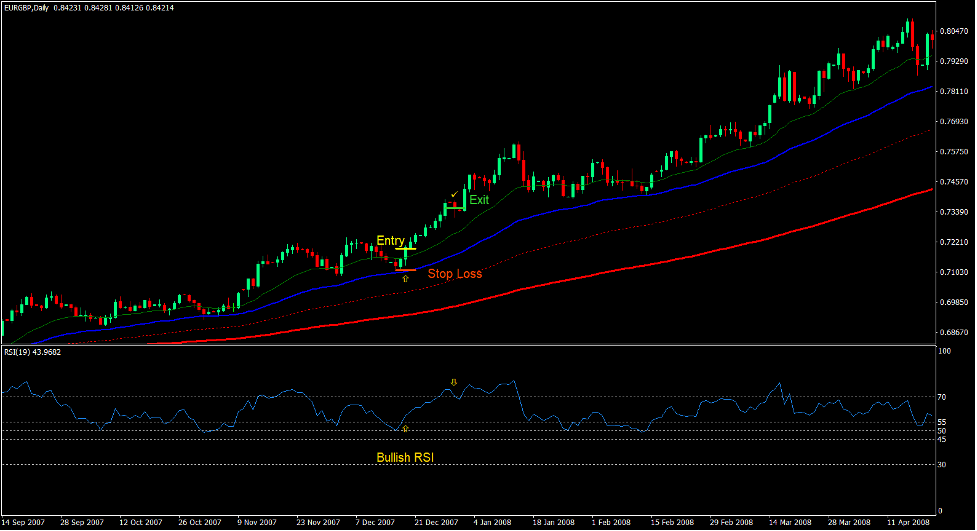

Access

- The Carter MA strains will have to be stacked within the following order:

- Inexperienced line: best

- Blue line: 2d from the highest

- Dotted crimson line: 2d from the ground

- Cast crimson line: backside

- Worth will have to have in the past bounced off the world adjoining to the blue line.

- Worth will have to retrace again in opposition to the world close to the blue line.

- Worth will have to shut above the golf green line.

- The RSI line will have to move above 55.

- Input a purchase order at the affirmation of those stipulations.

Prevent Loss

- Set the prevent loss on a toughen degree beneath the access candle.

Go out

- Shut the industry because the RSI line crosses again beneath 70 after a bullish momentum breakout.

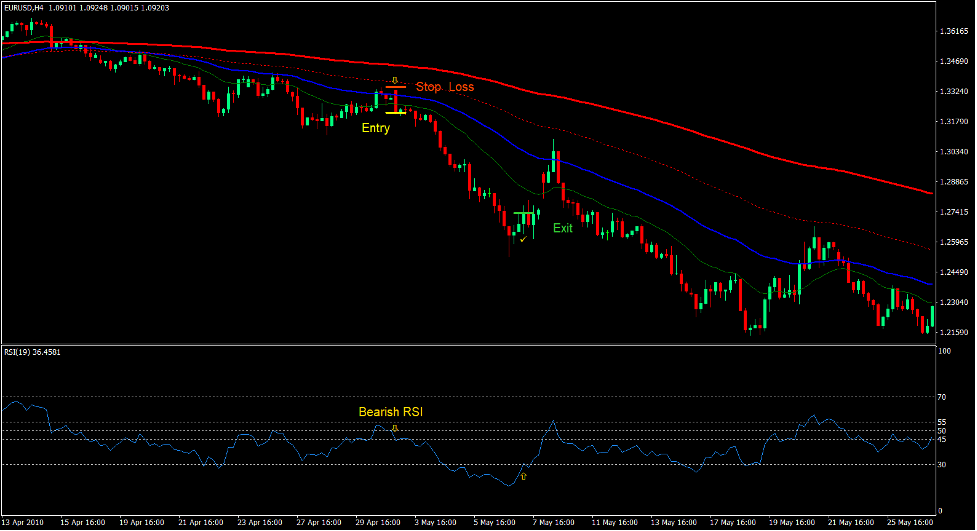

Promote Industry Setup

Access

- The Carter MA strains will have to be stacked within the following order:

- Inexperienced line: backside

- Blue line: 2d from the ground

- Dotted crimson line: 2d from the highest

- Cast crimson line: best

- Worth will have to have in the past bounced off the world adjoining to the blue line.

- Worth will have to retrace again in opposition to the world close to the blue line.

- Worth will have to shut beneath the golf green line.

- The RSI line will have to move beneath 45.

- Input a promote order at the affirmation of those stipulations.

Prevent Loss

- Set the prevent loss on a resistance degree above the access candle.

Go out

- Shut the industry because the RSI line crosses again above 30 after a bearish momentum breakout.

Conclusion

This straightforward development following technique is a operating technique which many advantageous investors use. Regardless of its simplicity, the setups produced via this technique generally tend to paintings in point of fact neatly.

The important thing to buying and selling this technique effectively is find a foreign exchange pair this is trending sufficiently. This may also be recognized in accordance with the traits of value motion, if it is plotting upper or decrease swing issues.

the Forex market Buying and selling Methods Set up Directions

Carter MA Dynamic House Jump the Forex market Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to change into the accrued historical past information and buying and selling indicators.

Carter MA Dynamic House Jump the Forex market Buying and selling Technique supplies a possibility to discover more than a few peculiarities and patterns in value dynamics which can be invisible to the bare eye.

In line with this data, investors can think additional value motion and alter this technique accordingly.

Beneficial the Forex market MetaTrader 4 Buying and selling Platform

- Loose $50 To Get started Buying and selling In an instant! (Withdrawable Benefit)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable the Forex market Dealer

- Further Unique Bonuses All the way through The 12 months

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By means of-Step XM Dealer Account Opening Information

Tips on how to set up Carter MA Dynamic House Jump the Forex market Buying and selling Technique?

- Obtain Carter MA Dynamic House Jump the Forex market Buying and selling Technique.zip

- *Replica mq4 and ex4 information for your Metatrader Listing / professionals / signs /

- Replica tpl record (Template) for your Metatrader Listing / templates /

- Get started or restart your Metatrader Shopper

- Make a selection Chart and Time-frame the place you wish to have to check your foreign exchange technique

- Proper click on for your buying and selling chart and hover on “Template”

- Transfer proper to make a choice Carter MA Dynamic House Jump the Forex market Buying and selling Technique

- You’re going to see Carter MA Dynamic House Jump the Forex market Buying and selling Technique is to be had for your Chart

*Be aware: Now not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Signs from the MetaTrader Platform.