BoC Prone to Stay Charges Unchanged

- A decline in Canada’s retail gross sales resulted in the weakening of the Canadian greenback.

- Oil costs settled decrease following the discharge of 2 US hostages by means of Hamas.

- The Financial institution of Canada will most probably care for its rates of interest at 5.00% for no less than six months.

The USD/CAD weekly forecast finds a bullish temper amongst buyers. They’re assured that the Financial institution of Canada will stay its charges unchanged, regardless of the emerging inflation and financial restoration. Which means that the Canadian greenback will stay below power, whilst america greenback will benefit from the enhance of the Fed’s tapering plans and powerful enlargement possibilities.

Ups and downs of USD/CAD

USD/CAD ended the week relatively upper because the Canadian greenback weakened towards the greenback. Particularly, a decline in Canada’s retail gross sales resulted in the weakening of the Canadian greenback. It solidified expectancies that the Financial institution of Canada will care for its present rates of interest subsequent week.

-Are you interested by finding out concerning the foreign exchange alerts telegram crew? Click on right here for details-

Moreover, the Canadian greenback weakened as oil costs settled decrease. This decline adopted the discharge of 2 US hostages by means of the Islamist crew Hamas in Gaza. In consequence, there may be hope that the Israeli-Palestinian disaster may de-escalate with out spreading and disrupting oil provides.

Subsequent week’s key occasions for USD/CAD

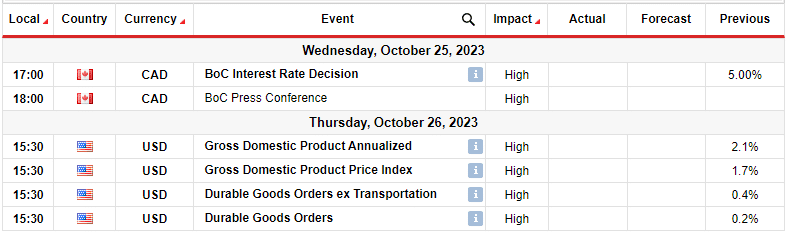

The marketplace individuals will keenly observe the BoC coverage assembly subsequent week. They’ll additionally obtain knowledge from america, together with GDP and sturdy items orders. Particularly, a Reuters ballot of economists means that the Financial institution of Canada will care for its rates of interest at 5.00% for no less than six months.

Till lately, the potential of a nil.25% price build up on October 25 used to be prime. Alternatively, a up to date file indicating lower-than-anticipated inflation in September has weakened that chance.

Additionally, the economic system is displaying pressure from 475 foundation issues in price hikes since early 2022, motivating policymakers to undertake a wait-and-see manner.

USD/CAD weekly technical forecast: Bullish bias prevails.

The unfairness for USD/CAD at the day by day chart is bullish. The associated fee is above the 22-SMA, and the RSI is located above 50, appearing a bullish transfer. Alternatively, the associated fee has paused between the 1.3600 enhance and the 1.3701 resistance degree. Bears and bulls display nearly equivalent energy as the associated fee oscillates on this vary space.

-Are you interested by finding out about foreign exchange signs? Click on right here for details-

Alternatively, bulls have the higher hand since this is occurring above the 22-SMA. Subsequently, the associated fee will most probably wreck above the 1.3701 resistance degree within the coming week. The sort of transfer would result in a retest of the 1.3800 resistance degree. Additionally, this may sign a continuation of the bullish pattern as the associated fee would make a better prime.

Taking a look to business foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must believe whether or not you’ll manage to pay for to take the prime chance of dropping your cash