Bears eye a run to 135.50

- USD/JPY bulls are conserving the fee increased above key 135.80-70 construction.

- Bears eye 135.50 within the close to time period on a spoil of hourly trendline toughen.

In spite of being extensively softer initially of the week throughout a basket of currencies, the USA Buck used to be up 0.24% in opposition to the Yen in noon industry on Wall Boulevard. USDJPY is these days buying and selling at 136.05 and has moved between a low of 135.62 and a top of 136.32.

The US Buck index, DXY, fell to a low of 102.382 at the day and used to be down from 102.752, a five-week top, confused by way of a susceptible production index in New York state and amid fears in regards to the debt ceiling and the USA economic system. This falls into the palms of the Yen and tallies with the next technical research:

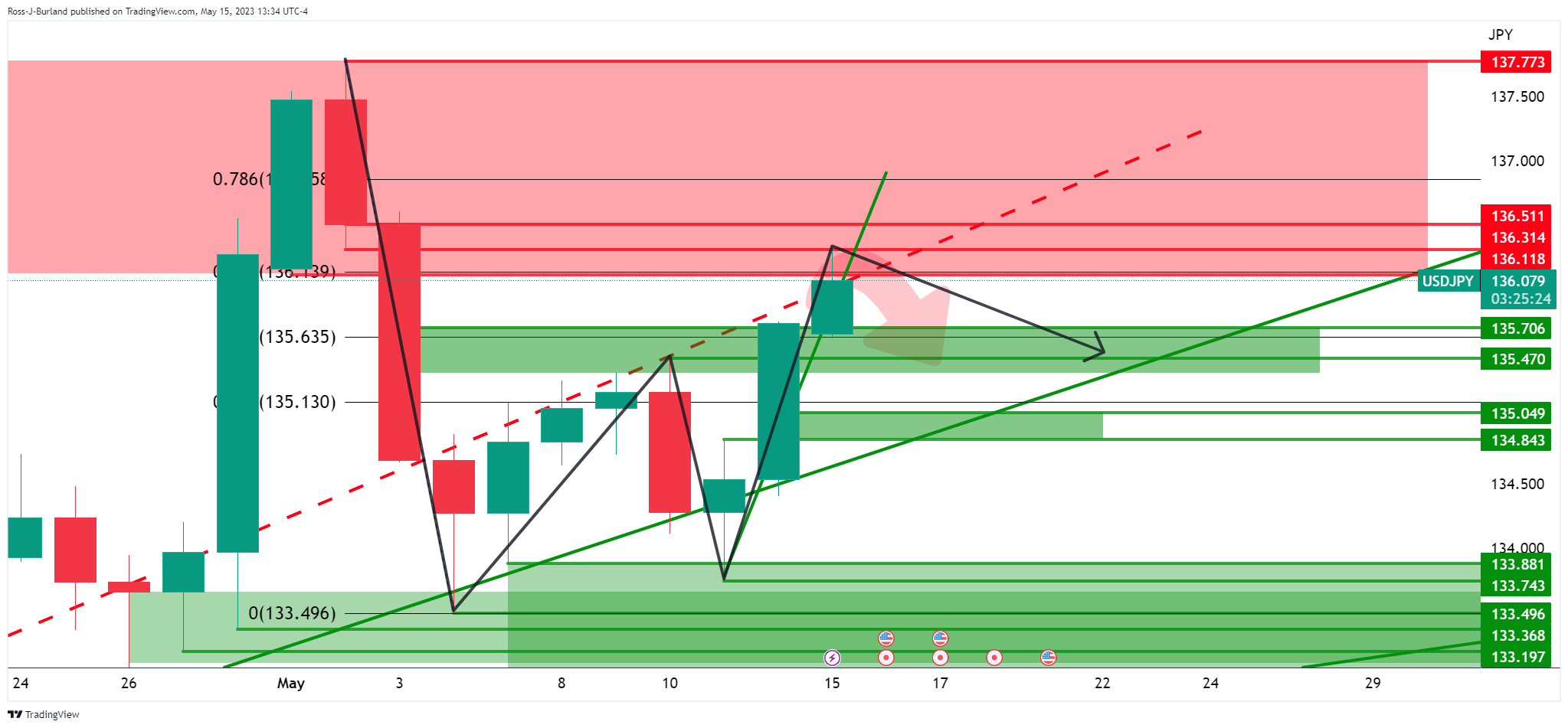

USD/JPY day-to-day charts

The W-formation is a bearish function at the day-to-day chart that would equate to a problem correction of the most recent bullish impùlse from the resistance house as highlighted within the charts above.

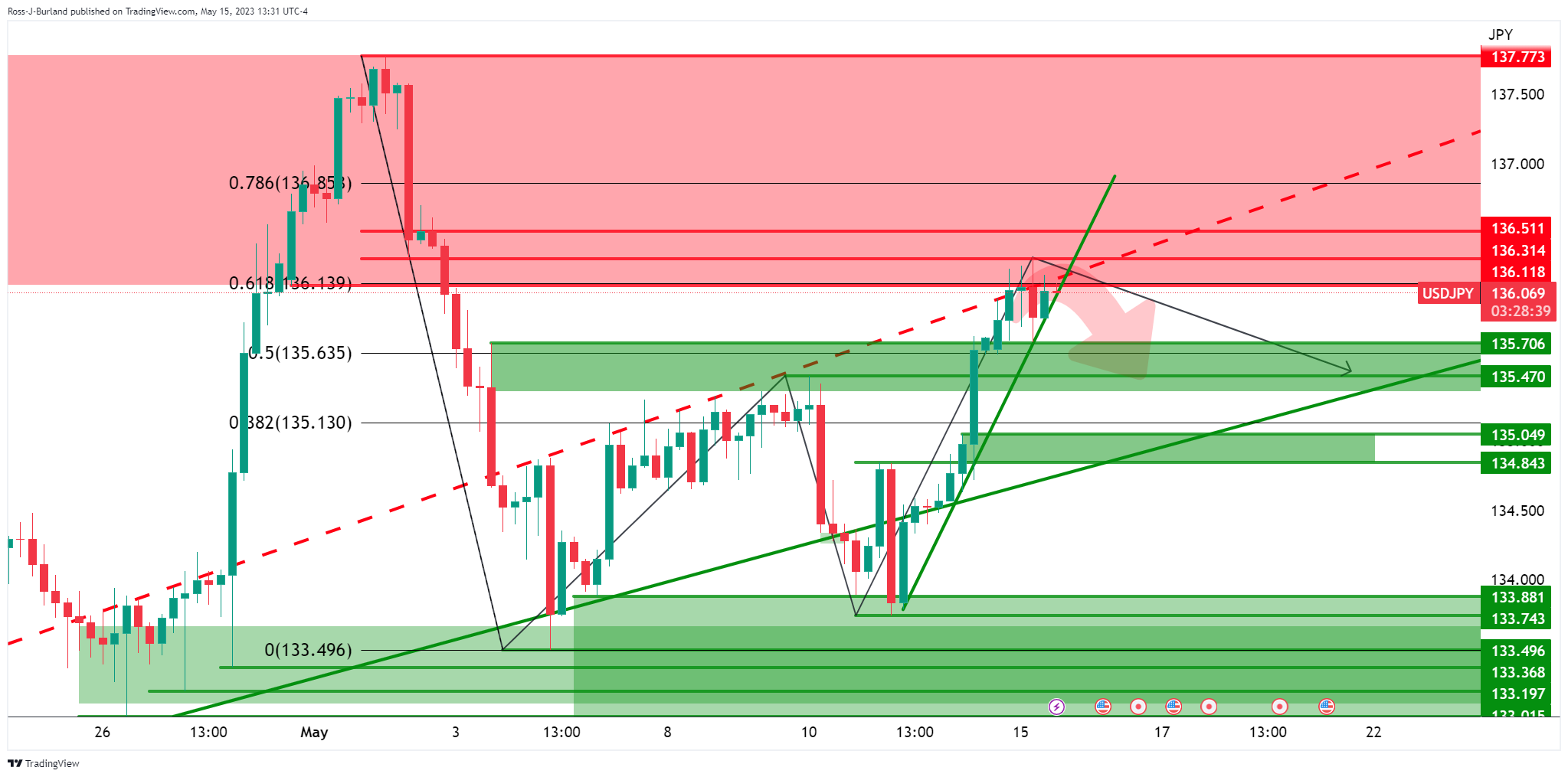

USD/JPY H4 chart

The 4-hour chart sees toughen coming in close to 135.70 and 135.50 forward of 135.00 and 134.80.

USD/JPY H1 chart

The bears will wish to get under the hourly chart´s toughen construction and 135.80-70.