AUD/USD Weekly Forecast: Hawkish RBA Fuels Rebound

- The greenback climbed previous within the week when tensions between Russia and Ukraine escalated.

- The Trump industry paused as investors awaited new traits.

- The Reserve Financial institution of Australia maintained its hawkish tone.

The AUD/USD weekly forecast displays a slight rebound because the RBA stays hawkish, however the pair nonetheless has problem doable.

Ups and downs of AUD/USD

The Aussie rebounded this week because the greenback paused its Trump rally and the RBA maintained a hawkish. The buck paused this week after a powerful rally because of Trump’s win. Alternatively, it climbed previous within the week when tensions between Russia and Ukraine escalated.

In the meantime, the Trump industry paused as investors awaited new traits. US knowledge confirmed an surprising decline in jobless claims, reducing the possibility of a December Fed price reduce.

In other places, the Reserve Financial institution of Australia maintained its hawkish tone, declaring there used to be no hurry to decrease charges as they weren’t as top as in different main economies.

Subsequent week’s key occasions for AUD/USD

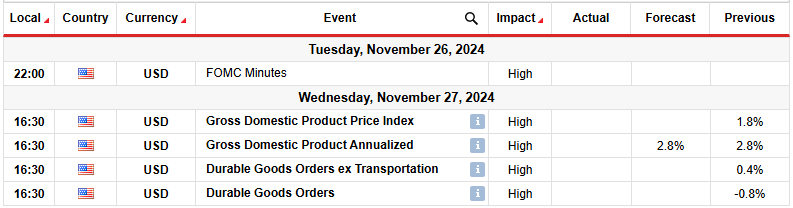

Subsequent week, buyers will center of attention on experiences from the USA, together with the Fed mins, GDP, and sturdy items orders. The FOMC assembly mins could have a complete record of the final coverage assembly, which may include clues on what policymakers intend to do at some point. The assembly got here proper after Trump received the USA presidential election, converting the outlook for US financial expansion and inflation. In consequence, marketplace individuals will wait to peer if this modified policymakers” tone.

In the meantime, the GDP record will display the well being of the financial system. Economists be expecting a 2.8% build up after a equivalent studying final month.

AUD/USD weekly technical forecast: RSI divergence activates pullback

At the technical aspect, the AUD/USD value is in a downtrend, persistently making decrease highs and lows. Additionally, the cost trades under the 22-SMA with the RSI underneath 50, supporting a bearish bias. The downtrend has paused on the 0.6450 important degree after breaking under the 0.6550 make stronger. The pause has allowed bulls to revisit the not too long ago damaged make stronger zone.

–Are you interested by studying extra about scalping foreign exchange agents? Test our detailed guide-

The pullback may proceed to the 22-SMA within the coming week ahead of bears resume the downtrend. To verify a continuation of the downtrend, the cost should damage under 0.6450 to make a brand new low. Alternatively, the RSI has made a slight bullish divergence that would sign a reversal. However, bulls should damage above the SMA to substantiate a reversal. In a different way, the downtrend will proceed.

Taking a look to industry foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must believe whether or not you’ll be able to have enough money to take the top possibility of shedding your cash.