Atmosphere Up the “Improve and Resistance In line with 240 Bars” Buying and selling Technique – R Weblog

As of late we can have a look at the medium-term Improve and Resistance In line with the 240 Bars technique. Improve and resistance ranges might be mechanically plotted the use of the SF Development Traces indicator as “bullish” and “bearish” channels. The tactic comes to buying and selling the pairs EUR/USD, GBP/USD, USD/JPY, USD/CAD, USD/CHF, and NZD/USD at the four-hour chart.

On this article we can provide an explanation for find out how to upload the indicator to the buying and selling terminal, talk about the foundations for opening and shutting positions, in addition to the subtleties of surroundings Forestall Loss and Take Benefit.

Putting in place the SF Development Traces indicator

- Obtain SF Development Traces

- Upload it to the put in buying and selling terminal through opening the MQL4 folder and pasting it into the Signs folder

- Upload a hallmark to the chart in MT4, operating from the menu: Insert → Signs → Customized → sf-trend-lines

- You’ll trade the color of the rage traces within the settings, however it is very important go away the selection of bars at 240 unchanged

SF Development Traces builds a value channel with the higher boundary appearing as important resistance, so a pullback is predicted from it. The decrease boundary of this channel is a important make stronger house, so an upward soar is predicted from it.

The indicator does now not construct all of the chart with channels; it builds best the true channel, because of this you can’t assess the standard of alerts at the historical past of the chart – best in actual time. There can best be one channel at the H4 chart.

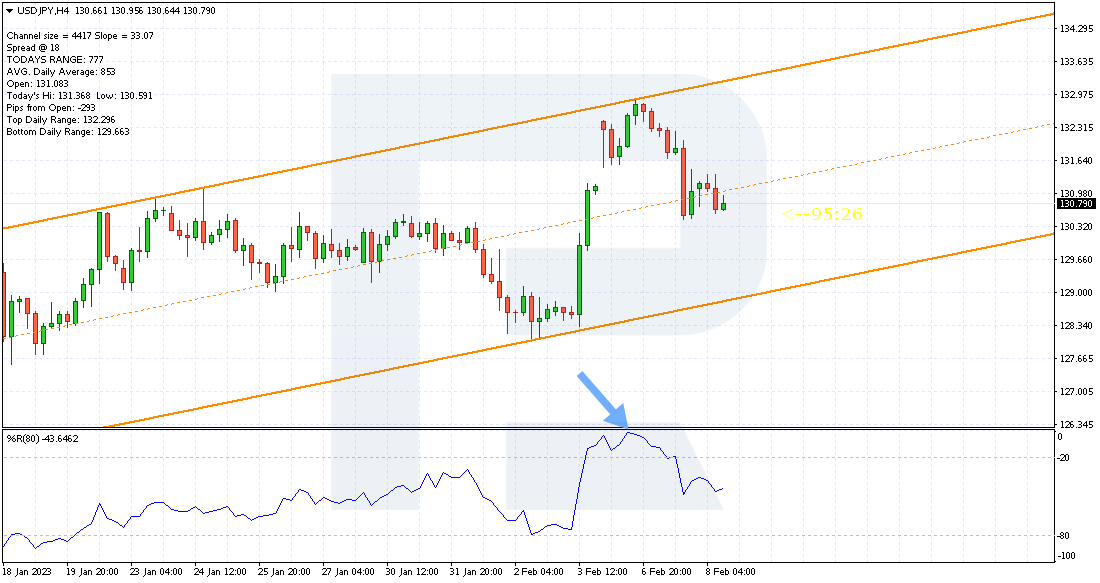

The best way to Purchase with Improve and Resistance In line with 240 Bars

1. The cost will have to succeed in the ground of the uptrend channel at the SF Development Traces indicator chart.

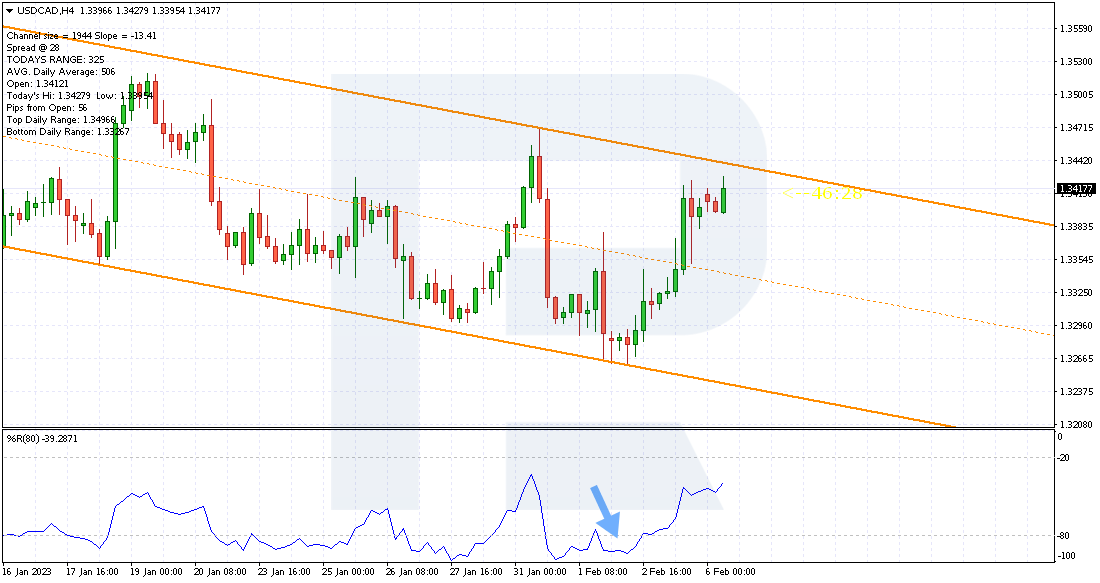

2. The Williams’ % Vary (Williams’ %R) indicator can be utilized as a affirmation sign. Its values will have to fall under the -80 stage.

3. Forestall Loss can also be set at the back of the decrease boundary line of the SF Development Traces channel. If the cost has already fallen under this line and rebounded, then the Forestall Loss will have to be set 5-10 issues under the candlestick’s low.

4. Take Benefit is according to a 1:4 benefit/loss ratio. If Forestall Loss is 30 issues, Take Benefit is 120.

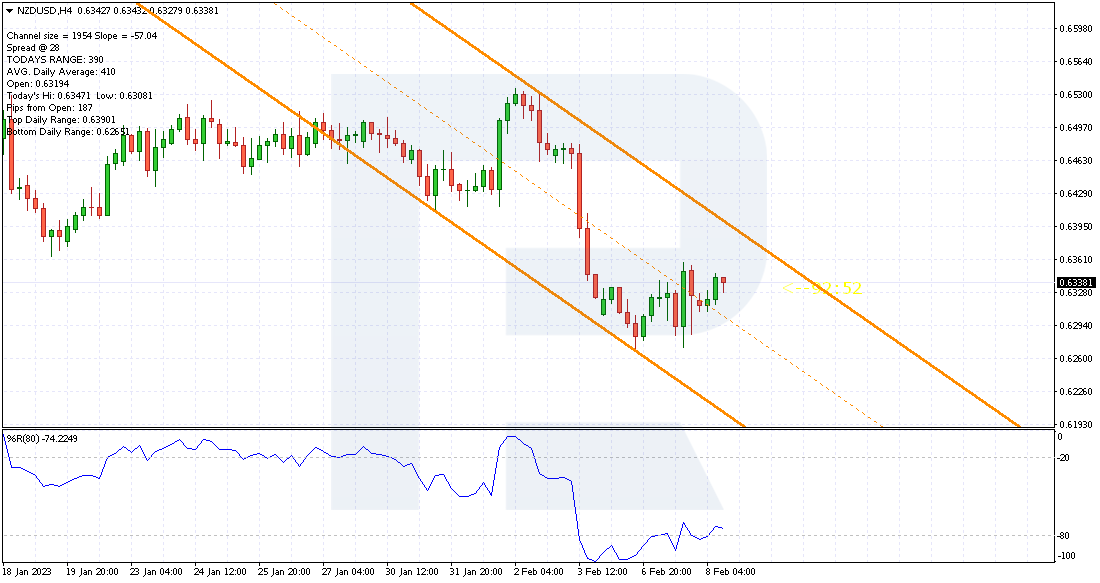

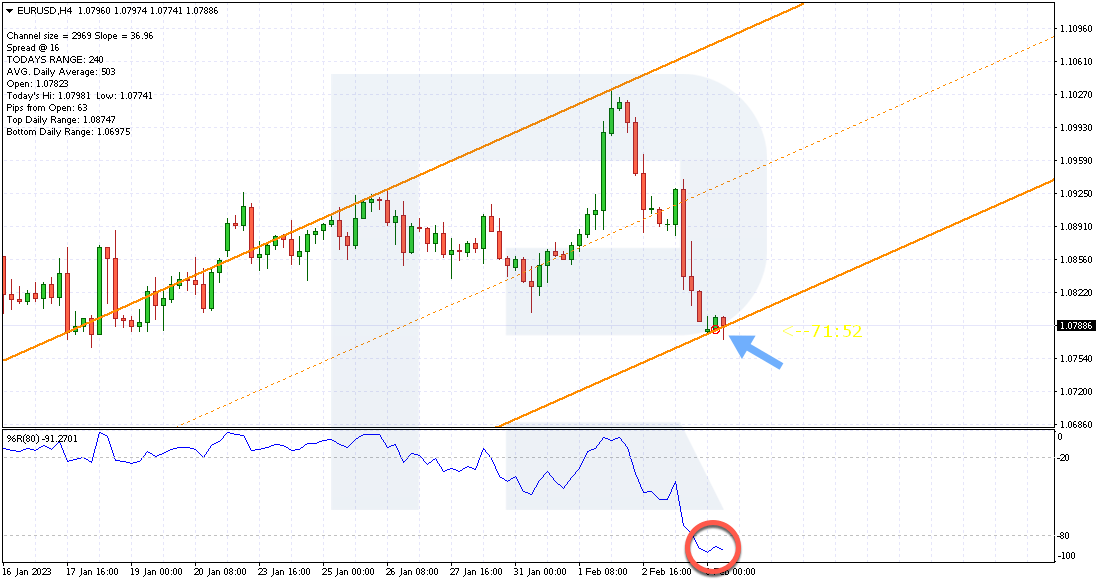

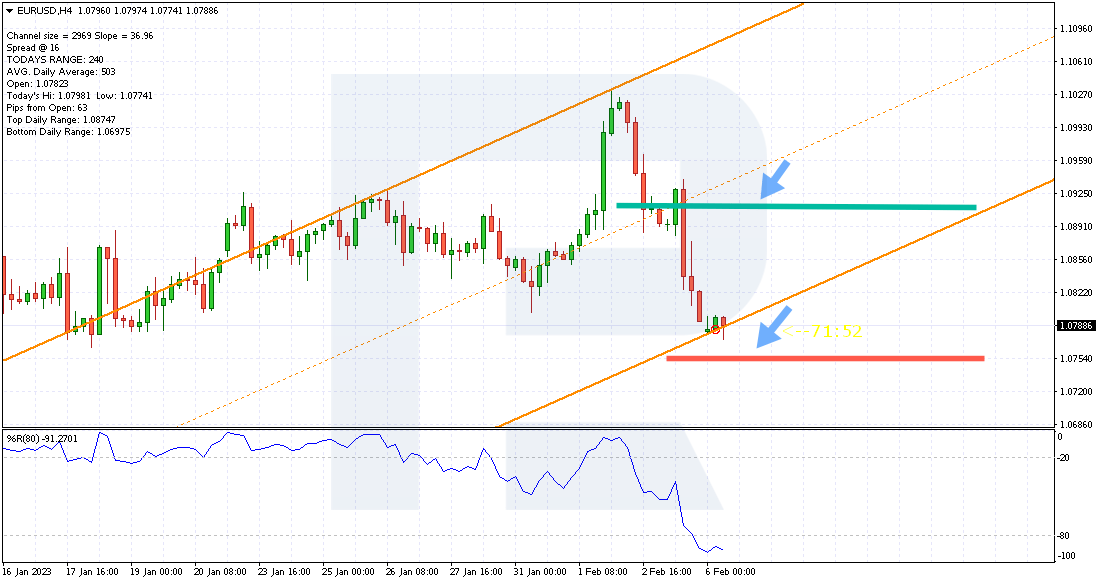

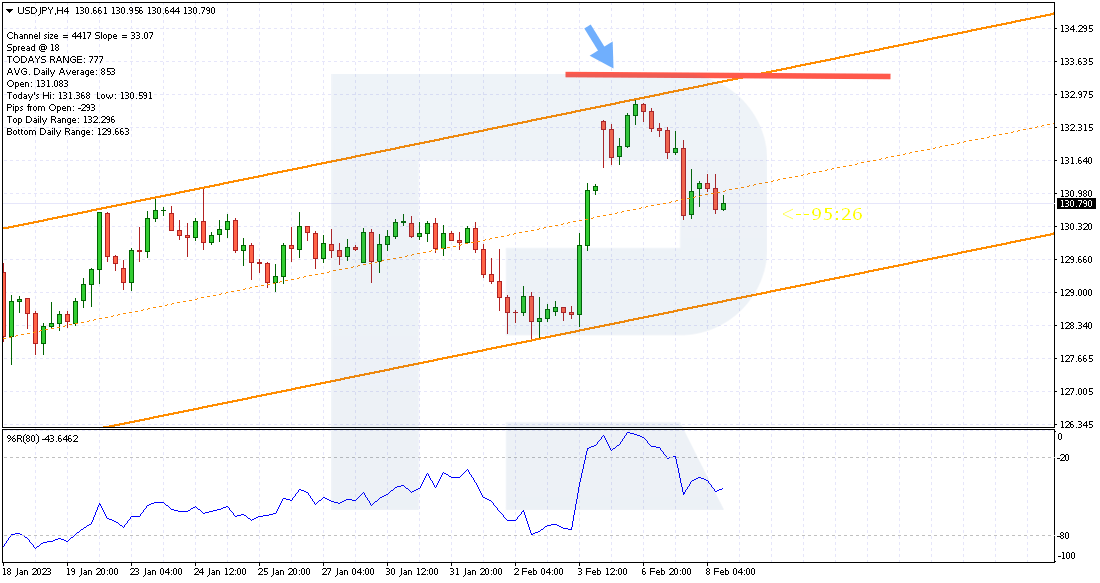

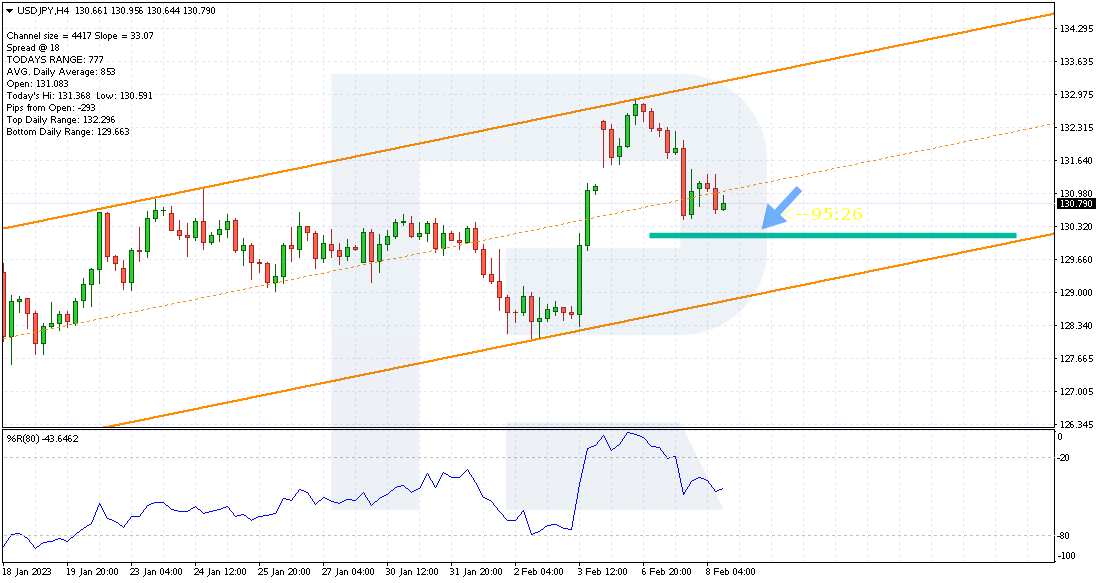

Improve and Resistance In line with the 240 Bars Purchasing Instance

- At the chart of the forex pair EUR/USD on 6 February 2023, after rebounding from the higher boundary of the “bullish” channel the place there used to be a powerful resistance stage, the cost fell and examined the make stronger line of the indicator SF Development Traces

- The Williams’ %R indicator used to be under -80, indicating that the forex pair used to be seriously oversold

- A protracted place used to be opened at 1.0786

- The forestall loss used to be positioned under the make stronger line, at 1.0756. Its measurement is 30 issues

- Take Benefit used to be set at 1.0906 Its measurement is 4 occasions the dimensions of the Forestall Loss

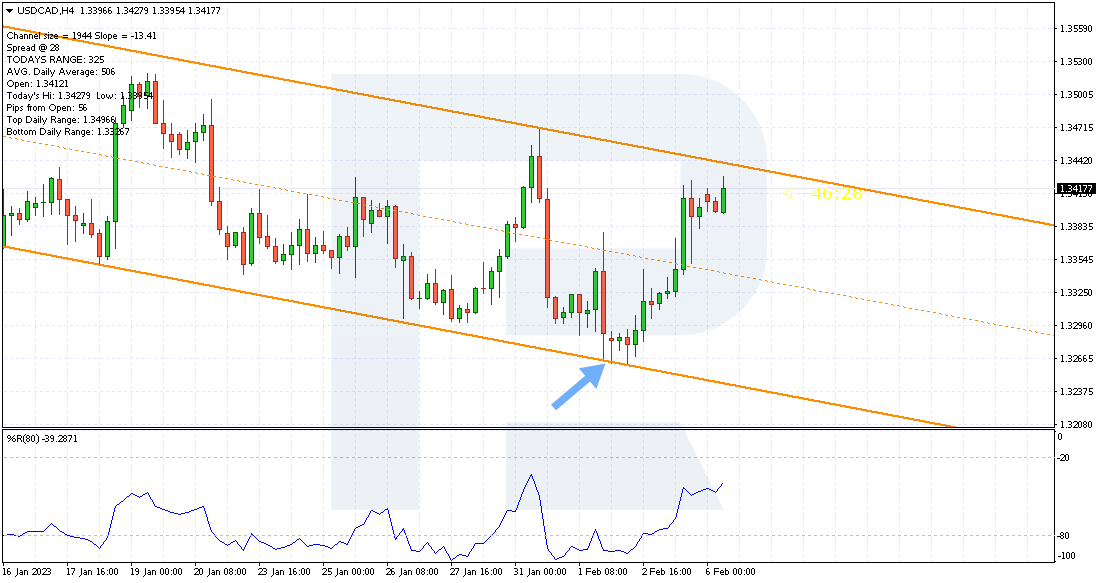

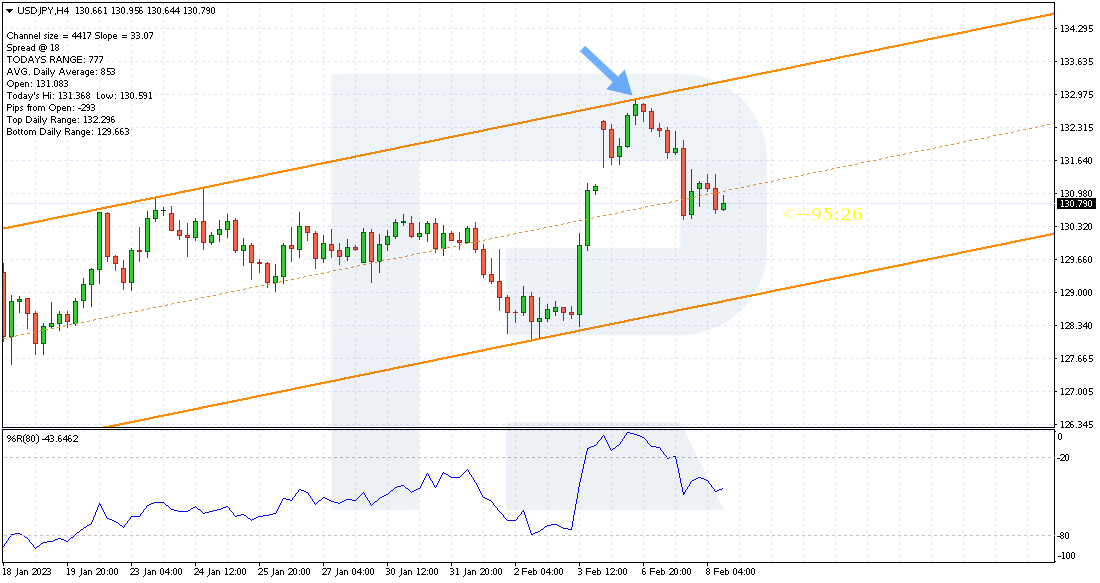

The best way to Promote through Improve and Resistance In line with 240 Bars

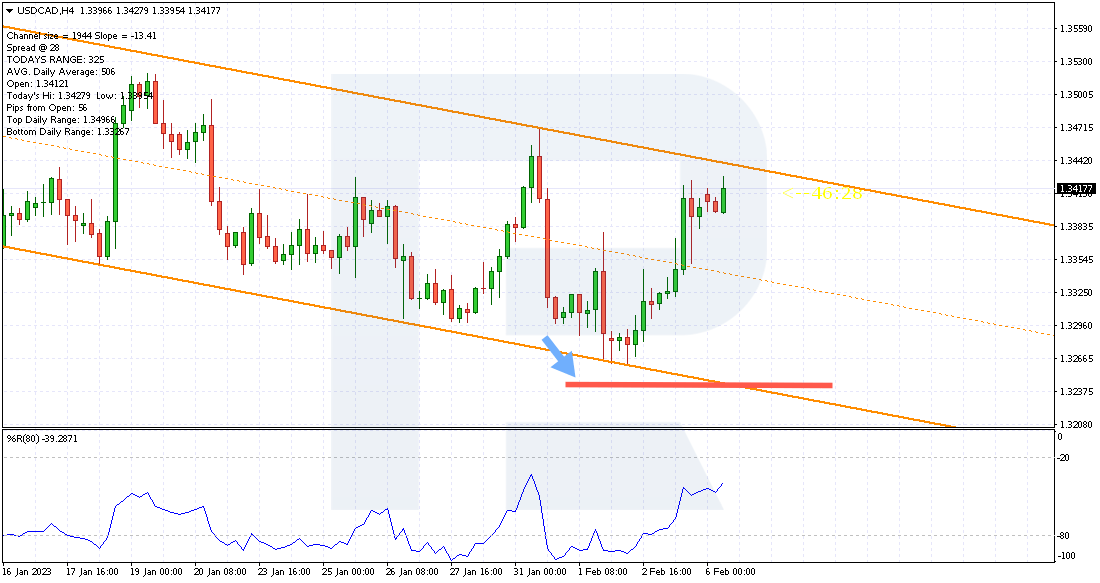

1. The cost will have to succeed in the higher restrict of the descending channel at the SF Development Traces indicator chart.

2. The Williams’ % Vary (Williams’ %R) indicator will have to upward thrust above the -20 stage.

3. Forestall Loss can also be set at the back of the higher restrict line of the SF Development Traces channel. If the cost has already risen above this line and returned, then the Forestall Loss will have to be set 5-10 issues above the candlestick’s most.

4. Take Benefit is according to a 1:4 benefit/loss ratio. If Forestall Loss is 20 issues, Take Benefit is 80 issues.

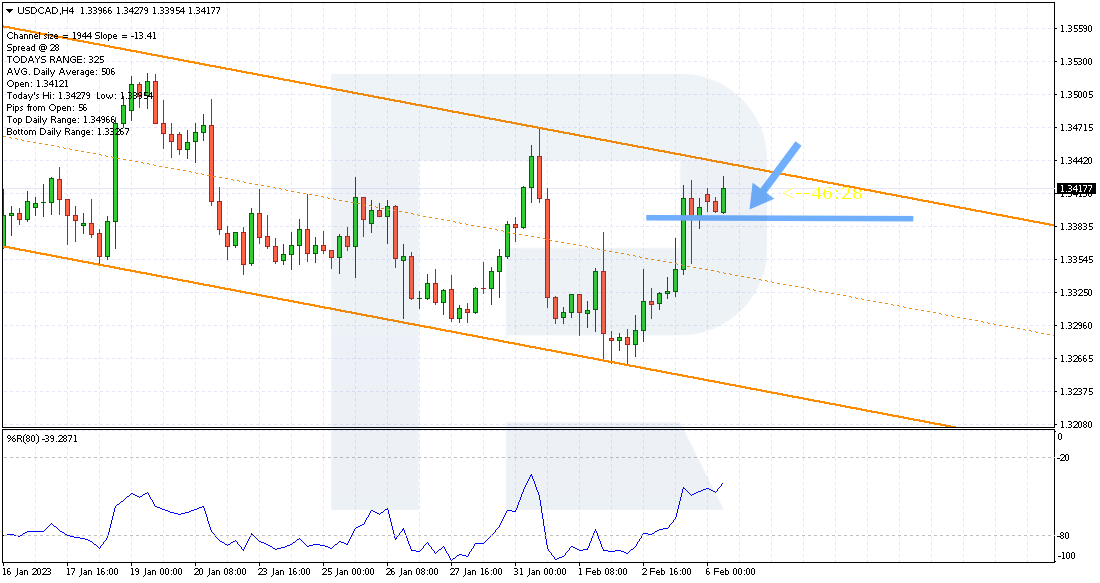

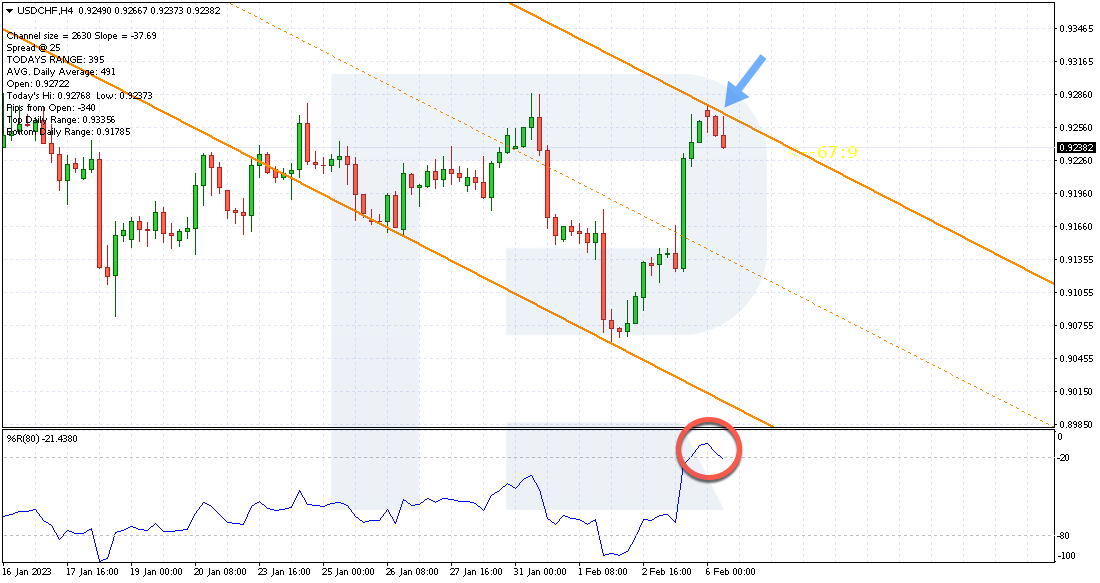

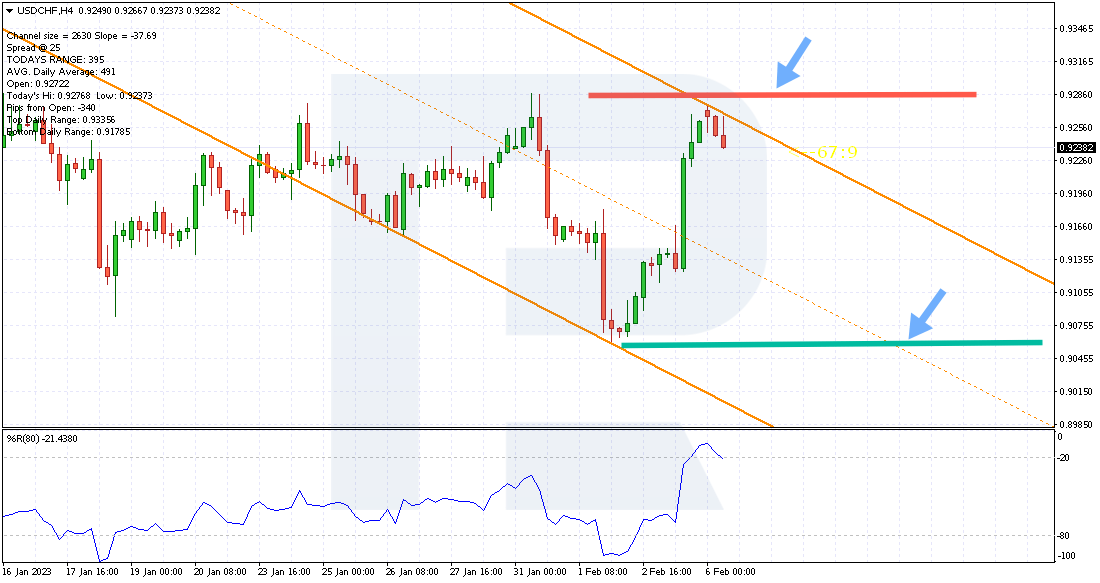

Instance of a Improve and Resistance In line with 240 Bars technique

- At the USD/CHF forex pair chart from 6 February 2023, the cost has already been driven clear of the higher boundary of the descending channel

- The Williams’ %R indicator used to be above the -20 stage, indicating that the forex pair used to be closely overbought

- A brief place used to be opened at 0.9237

- The forestall loss used to be set above the higher boundary of the descending channel, at 0.9280. Its measurement is 43 issues

- Take Benefit used to be set at 0.9065. Its measurement is 4 occasions the dimensions of the Forestall Loss

Conclusion

The Improve and Resistance In line with the 240 Bars buying and selling technique is a medium-term variant that works in line with easy regulations. To search out the access level, you wish to have to obtain and set up the indicator SF Development Traces, which is able to draw the upward and downward channels. The limits of those channels are the important make stronger and resistance ranges from which you will have to paintings for a soar. The Williams’ %R indicator is used as an auxiliary sign.

The primary good thing about the method is that there is not any subjective issue. Buyers don’t find out about the chart themselves, however follow the development of the indicator and decide. The second one merit is chance control: the benefit will have to exceed the loss through an element of four.

An important drawback of the method is the impossibility to check the information on historical past: the SF Development Traces indicator redraws channels, because of this just one channel will all the time be related.