Loan Passion and Prohibit in TurboTax, H&R Block, FreeTaxUSA

Many householders refinanced to a sub-3% loan when rates of interest had been low a few years in the past. The loan pastime the general public pay isn’t big enough to cause them to itemize their deductions. They only take the usual deduction. Those that can nonetheless deduct their loan pastime generally tend to have a big loan.

Prohibit on Deduction

The Tax Cuts and Jobs Act of 2017 diminished the restrict at the loan stability on which you’ll deduct the loan pastime from $1 million to $750,000. The decrease restrict applies to properties got after December 15, 2017. The massive building up in house costs in recent times makes not too long ago purchased properties in high-price spaces much more likely to exceed the $750,000 restrict.

On the other hand, lenders nonetheless document 100% of the loan pastime paid at the 1098 shape with out adjusting for both the previous $1 million restrict or the brand new $750,000 restrict. In case your loan stability is over the restrict, deducting the loan pastime is extra difficult than simply the usage of the quantity from the 1098 shape.

It isn’t merely multiplying $750,000 by way of your rate of interest both when your loan stability began above $750,000 and ended beneath $750,000 or while you took out the mortgage in the midst of the yr.

Moderate Loan Stability

A key idea is your reasonable loan stability all the way through the yr. When your reasonable loan stability exceeds the restrict, your deductible loan pastime is:

Mortgage Prohibit / Moderate Loan Stability * Exact Mortage Passion Paid

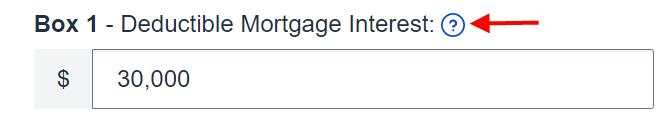

In the event you paid $30,000 in loan pastime on a median loan stability of $one million and also you’re matter to the $750,000 restrict, your deductible loan pastime is pro-rated to:

$750,000 / $one million * $30,000 = $22,500

IRS E-newsletter 936 provides a number of techniques to calculate your reasonable loan stability:

- Moderate of first and final stability means

- Passion paid divided by way of rate of interest means

- Loan statements means

The primary means is more practical and it offers you a somewhat higher deduction however you’ll use it provided that you didn’t prepay multiple month’s important all the way through the yr.

Right here’s the way it works in TurboTax, H&R Block, and FreeTaxUSA tax instrument.

TurboTax

The screenshots beneath are taken from TurboTax Deluxe downloaded instrument. The TurboTax downloaded instrument is each more cost effective and extra robust than TurboTax on-line instrument. In the event you haven’t paid on your TurboTax on-line submitting but, you’ll purchase TurboTax obtain from Amazon, Costco, Walmart, and plenty of different puts and transfer from TurboTax on-line to TurboTax obtain (see directions for tips on how to make the transfer from TurboTax).

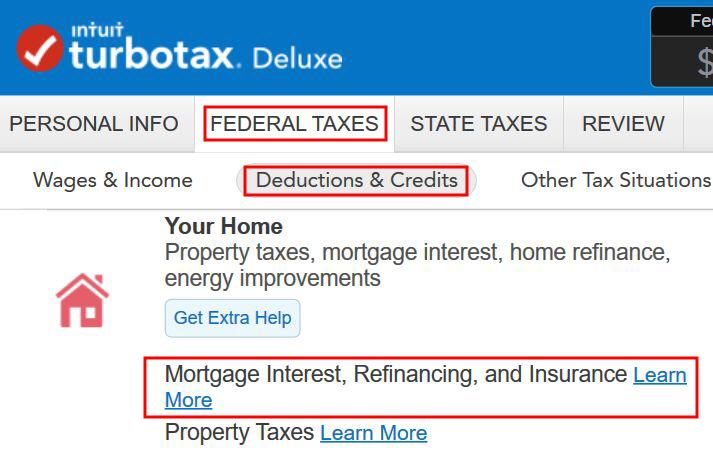

To find the loan pastime subject within the Your House segment below Federal Taxes -> Deduction & Credit.

Shape 1098

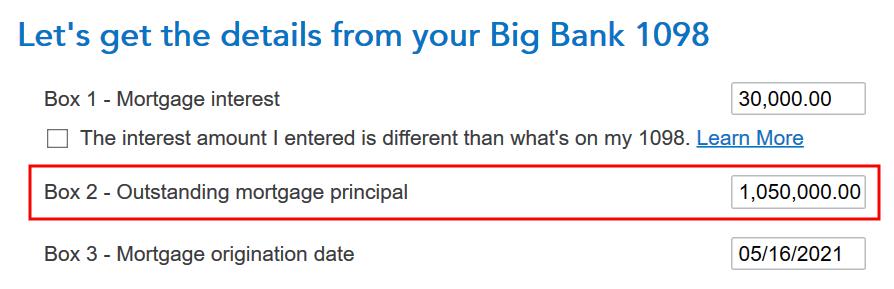

When it asks you to go into data out of your 1098 shape, input the numbers as they seem for your shape. If Field 2 is clean for your 1098, input the loan stability on the starting of the yr (or your starting mortgage stability in the event you took out the mortgage all the way through the yr).

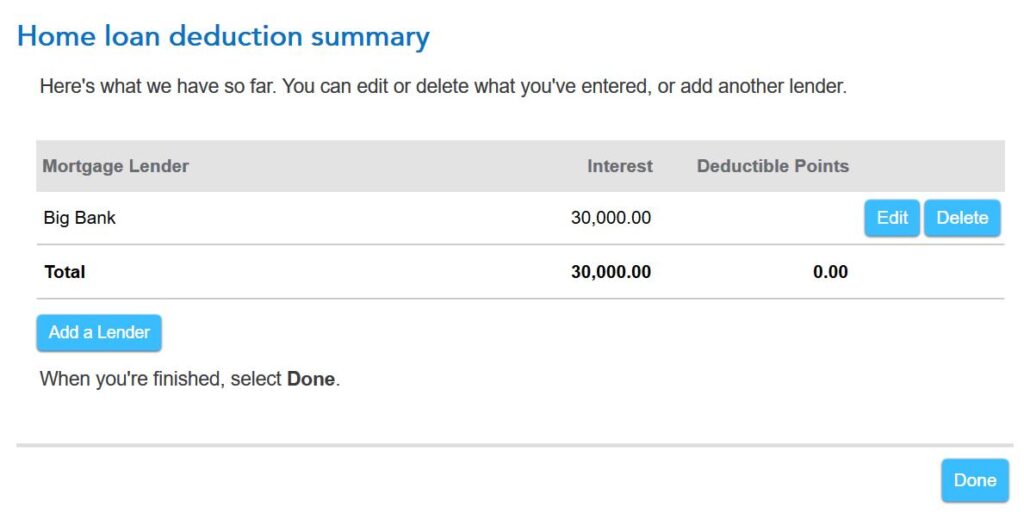

You get to this abstract after you resolution a couple of extra questions. Click on on Completed however you’re no longer achieved but.

Acquire Date and Finishing Stability

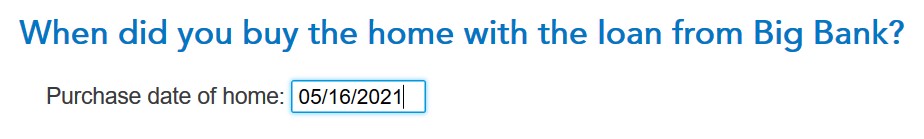

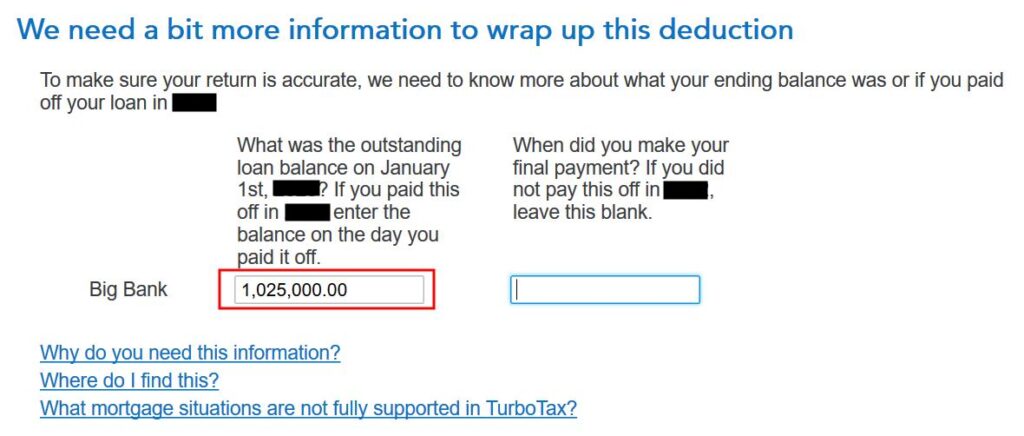

The acquisition date of the house determines whether or not you’ve a $1 million restrict or a $750,000 restrict for the loan pastime deduction. If this loan was once from a refinance, you continue to input the date while you initially purchased the house.

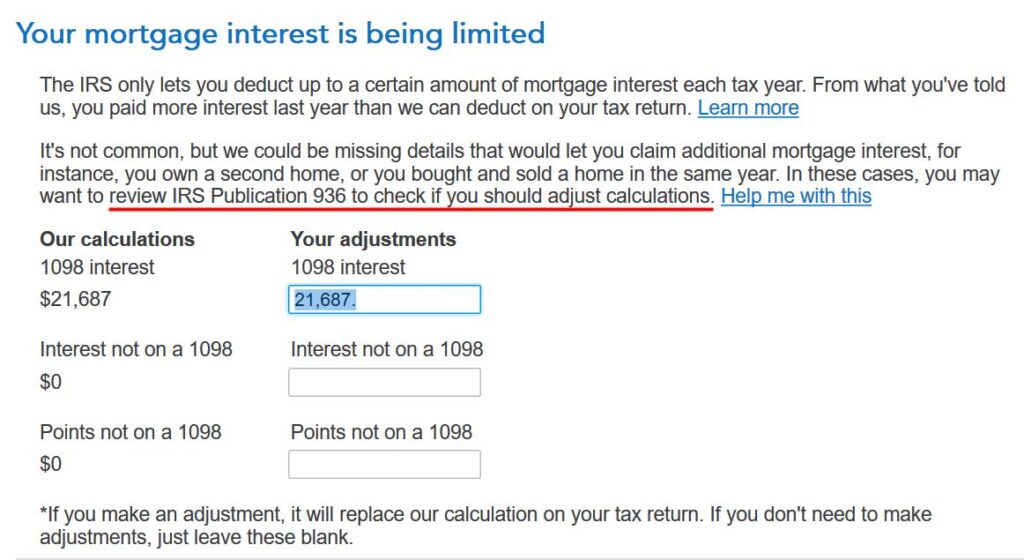

TurboTax asks for the stability as of January 1 of the next yr as it makes use of the “reasonable of first and final stability means” to calculate your reasonable loan stability for the yr. This works while you didn’t make further important bills all the way through the yr.

TurboTax calculates a deduction the usage of the “reasonable of first and final stability means” however you’ll’t legally use that means in the event you pay as you go multiple month’s important all the way through the yr. You will have to calculate your reasonable loan stability otherwise and provides the pro-rated deductible loan pastime to TurboTax.

If You Pay as you go Most important

In the event you had the loan for all 365 days and your rate of interest didn’t alternate all the way through the yr, which is the case for the general public with a fixed-rate loan, you’ll use the “pastime paid divided by way of rate of interest means” to calculate your reasonable loan stability. Think you paid $30,000 in loan pastime and your price is two.875%, your reasonable loan stability is:

$30,000 / 0.02875 = $1,043,478

Your deductible loan pastime is:

$750,000 / $1,043,478 * $30,000 = $21,562

In case your pastime modified all the way through the yr, you’re at an advantage the usage of the “loan statements means.” Obtain the per month statements out of your lender. Upload up your stability from January to December and divide by way of 12. That’s your reasonable loan stability all the way through the yr. Use that quantity to calculate your pro-rated deductible loan pastime and provides it to TurboTax:

Mortgage Prohibit / Moderate Loan Stability * Exact Mortage Passion Paid

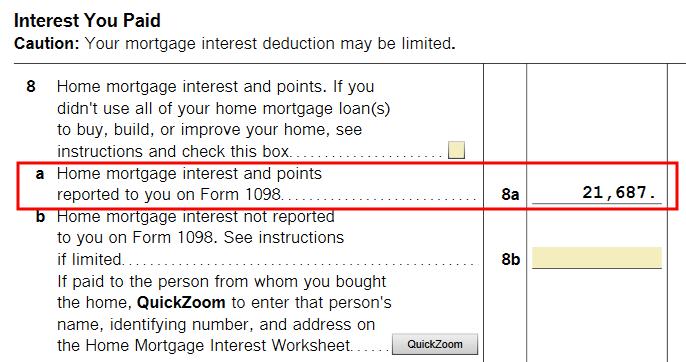

Examine on Time table A

To verify how a lot loan pastime deduction you’re getting, click on on Bureaucracy at the best proper and in finding Time table A within the checklist of paperwork within the left panel.

Scroll all the way down to the center and in finding Line 8. You’ll see the loan pastime deduction.

H&R Block

Loan pastime deduction works in a different way within the H&R Block instrument.

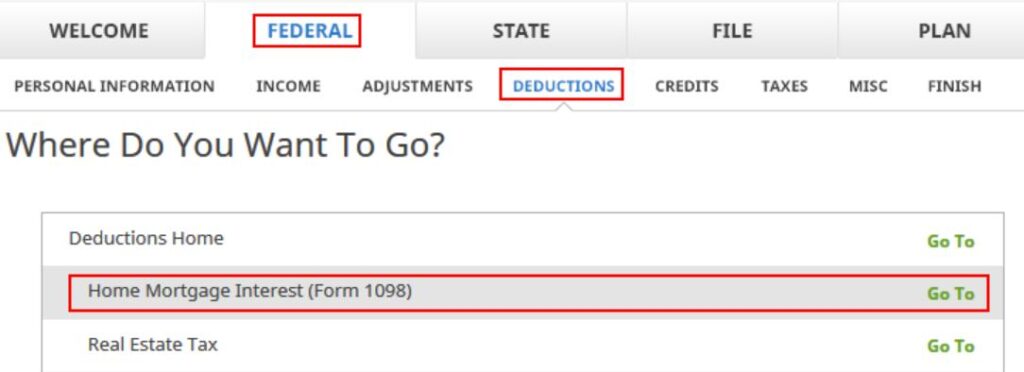

To find “House Loan Passion (Shape 1098)” below Federal -> Deductions.

1098 Entries

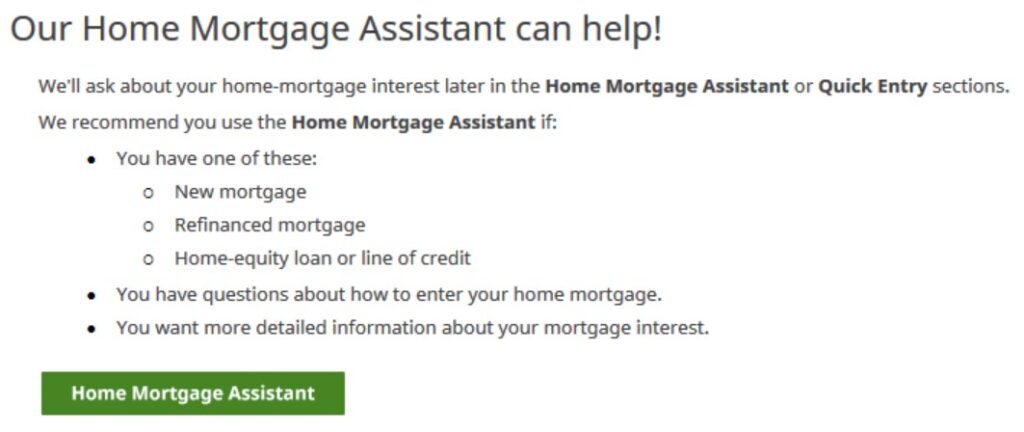

H&R Block provides a House Loan Assistant. Click on on that.

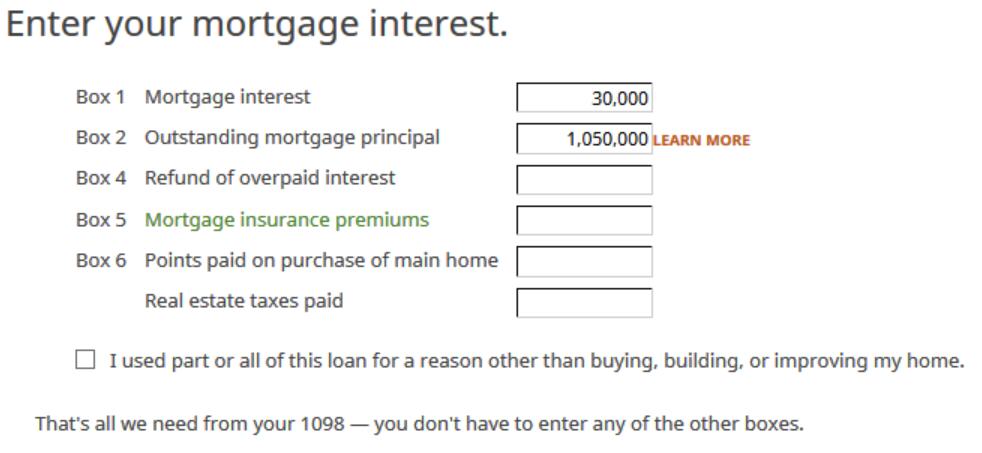

After announcing we’ve got a 1098 shape and coming into the title of the lender, we come to this type to go into the numbers at the 1098 shape.

Mistaken!

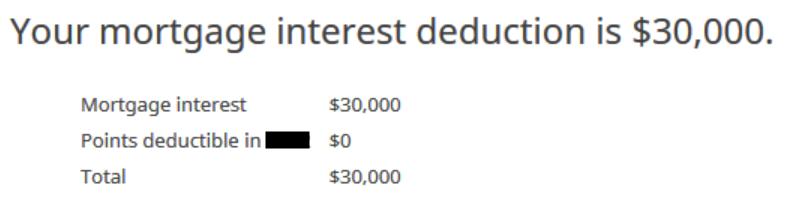

After answering some extra questions on issues and loan insurance coverage premiums, which we don’t have, H&R Block says we will deduct 100% of the loan pastime paid.

It will’t be proper. We entered a starting stability above $1 million at the 1098 shape. H&R Block didn’t ask for the house acquire date to peer whether or not the restrict is $1 million or $750,000. It didn’t ask for the finishing stability or the rate of interest to calculate the typical loan stability. H&R Block simply makes use of the pastime paid quantity from the 1098 shape as though the mortgage restrict doesn’t exist.

Calculate It Your self

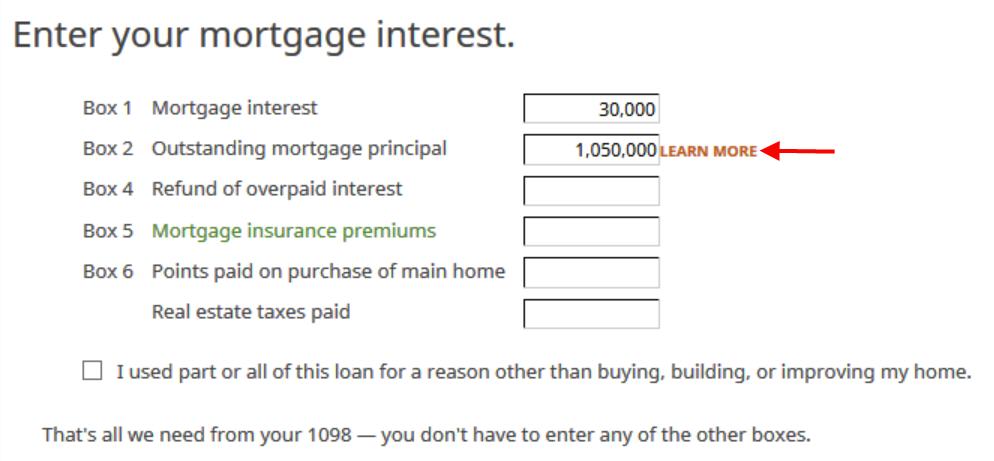

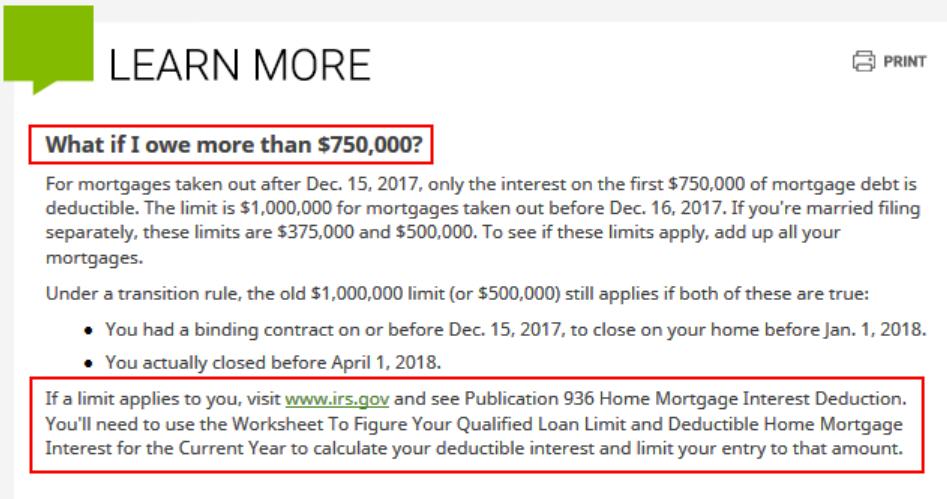

We return to the 1098 entries to peer if we ignored the rest. See there’s a Be informed Extra hyperlink subsequent to Field 2? What’s that?

There’s our resolution. It says on the finish:

If a restrict applies to you, consult with www.irs.gov and spot E-newsletter 936 House Loan Passion Deduction. You’ll want to use the Worksheet To Determine Your Certified Mortgage Prohibit and Deductible House Loan Passion for the Present Yr to calculate your deductible pastime and restrict your access to that quantity.

Translation: You’re by yourself when your loan is over $750,000. Calculate it your self and put the end result right here.

Granted that TurboTax doesn’t quilt all eventualities however no less than it makes an try to quilt the most typical situation (handiest common bills with out further important bills). H&R Block simply washes its fingers and places all of it on you when your loan is above the restrict. That’s lazy. Even though just a small share of other folks deduct their loan pastime now, amongst those that can nonetheless deduct, many have a loan above the restrict.

It’s dangerous sufficient that the instrument doesn’t do the important paintings that will help you calculate, nevertheless it’s inexcusable that it doesn’t provide you with a warning extra conspicuously you’re by yourself. Many of us gained’t understand the ideas hidden at the back of a delicate Be informed Extra hyperlink.

So what do you do in the event you’re the usage of the H&R Block instrument? Do what TurboTax does. First, calculate your reasonable loan stability:

- In the event you didn’t prepay multiple month’s important, get the start stability and the finishing stability. Take a median.

- In the event you made further important bills and your rate of interest didn’t alternate, divide the pastime paid by way of your rate of interest.

Then, calculate your deductible loan pastime:

Mortgage Prohibit / Moderate Loan Stability * Exact Mortage Passion Paid

FreeTaxUSA

I additionally checked how the net tax instrument FreeTaxUSA does it.

Very similar to H&R Block, FreeTaxUSA places a small query mark hyperlink subsequent to the loan pastime access. Clicking at the query mark opens a pop-up window, which says towards the tip:

In case your debt is upper than the bounds, use E-newsletter 936 to determine your deductible house loan pastime quantity and cut back the loan pastime you input accordingly.

You’re additionally by yourself while you use FreeTaxUSA. It additionally doesn’t inform you obviously that you just will have to do a little further paintings.

***

H&R Block tax instrument is more cost effective than TurboTax however this isn’t the one case the place it punts and asks you to learn the IRS directions and are available again with the solution your self. See any other instance in The way to Input 2022 International Tax Credit score Shape 1116 in H&R Block. You in point of fact have to grasp the place it cuts corners while you use H&R Block instrument. It really works smartly handiest when the ones minimize corners don’t have an effect on you. The similar additionally applies to FreeTaxUSA.

Say No To Control Charges

If you’re paying an guide a share of your property, you’re paying 5-10x an excessive amount of. Learn to in finding an impartial guide, pay for recommendation, and handiest the recommendation.