Learn how to Purchase Treasury Expenses & Notes At the Secondary Marketplace

I confirmed how to shop for new-issue Treasury expenses and notes within the earlier submit How To Purchase Treasury Expenses & Notes With out Charge at On-line Agents. Purchasing a brand new difficulty is the perfect and the least pricey manner for most of the people. You must take a look at to stick with new problems for probably the most phase.

Alternatively, from time to time it’s important to shop for Treasuries at the secondary marketplace. Main on-line agents similar to Constancy, Forefront, and Charles Schwab don’t rate charges for getting Treasuries at the secondary marketplace both. I display you do it on this submit.

What Is the Secondary Marketplace

Purchasing at the secondary marketplace is like purchasing a used automobile. Any individual purchased the Treasuries when the federal government bought them emblem new. Now they’re reselling them. You’re purchasing those “pre-owned” Treasuries while you purchase at the secondary marketplace.

You’re now not getting an inferior product while you purchase “pre-owned” Treasuries at the secondary marketplace. The U.S. executive nonetheless promises complete bills of each fundamental and hobby. As such, you’re now not getting a discount both while you purchase at the secondary marketplace as hostile to shopping for new problems.

Why Secondary Marketplace

Two situations make it important to shop for at the secondary marketplace.

Time period Now not To be had As New Factor

New-issue Treasuries are available those maturities:

- 1-month (4-week)

- 2-month (8-week)

- 3-month (13-week)

- 4-month (17-week)

- 6-month (26-week)

- 1-year (52-week)

- 2-year

- 3-year

- 5-year

- 7-year

- 10-year

- 20-year

- 30-year

If you need a Treasury that matures in 9 months, 18 months, or 4 years, you received’t have the ability to get it as a brand new difficulty. The best choice is to shop for it at the secondary marketplace. A 1-year Treasury issued 3 months in the past has 9 months to run via now. It’ll be your 9-month Treasury while you purchase it at the secondary marketplace.

Don’t Need to Wait

The federal government sells new-issue Treasuries on a preset agenda. Brief-term Treasury Expenses pop out weekly. Longer maturities (1-year and up) pop out handiest as soon as a month. If you happen to’d like to shop for them as of late and don’t wish to wait till the following scheduled sale, your best option is to shop for at the secondary marketplace.

For instance, as I’m scripting this, the following scheduled sale for a 1-year (52-week) Treasury can be on November 29 and the only after that can be on December 27. If you happen to pass over the November 29 sale and also you don’t wish to wait till December 27, you’ll have to shop for it at the secondary marketplace.

TIPS

The to be had phrases and the gross sales agenda particularly impact TIPS — the inflation-protected Treasury bonds. New problems with TIPS bonds handiest are available those maturities and frequencies these days:

| Adulthood | New Factor Frequency |

|---|---|

| 5-year | 4 instances a 12 months (April, June, October, December) |

| 10-year | 6 instances a 12 months (January, March, Would possibly, July, September, November) |

| 30-year | Two times a 12 months (February, August) |

If you need a 2-year TIPS or if you need a 5-year TIPS in January, you’ll have to shop for it at the secondary marketplace.

Recognized Value and Yield

Whilst you purchase a brand new difficulty, you put your order with out understanding precisely what the associated fee and yield can be, for the reason that value and yield are decided via an public sale (see the former submit How To Purchase Treasury Expenses & Notes With out Charge at On-line Agents). You’re trusting you’ll get a just right value and yield since you’ll pay the similar value for your small order as banks purchasing $100 million. Costs can transfer between the time you put the order and the time the public sale completes. The real yield you get could also be upper or not up to the going yield you notice while you position the order.

Whilst you purchase at the secondary marketplace, you get a quote before you purchase. You understand precisely what yield you’re getting. Some folks choose this simple task versus now not understanding what value and yield they’ll get on new problems.

This 3rd reason why to shop for at the secondary marketplace is handiest private choice. Despite the fact that you’ll be able to’t know the associated fee and yield on a brand new difficulty forward of time, the real yield you find yourself getting is incessantly higher than the yield you’ll be able to get at the secondary marketplace.

Now not All Agents Be offering New Problems

One more reason to shop for at the secondary marketplace is that now not all agents be offering new-issue Treasuries. Merrill Edge, as an example, doesn’t be offering new-issue Treasuries on-line. It’s a must to name and pay a price to have a consultant position the order if you need a brand new difficulty, however you’ll be able to purchase at the secondary marketplace on-line and not using a price. If you happen to should use Merrill Edge, purchasing at the secondary marketplace more than likely nonetheless beats paying a price each time to shop for a brand new difficulty.

You’ll purchase new-issue Treasuries on-line and not using a price at Forefront, Constancy, Charles Schwab, and E*Business. See detailed steps with screenshots in How To Purchase Treasury Expenses & Notes With out Charge at On-line Agents.

The Problem

Purchasing at the secondary marketplace has some disadvantages.

Bid/Ask Unfold

The most important downside is the bid/ask unfold. You’re purchasing from bond sellers while you purchase Treasuries at the secondary marketplace. The adaptation between the associated fee you pay while you purchase and the associated fee you obtain while you promote is the bid/ask unfold. The real value is someplace in between. You’re paying a reasonably upper value than the actual value while you purchase at the secondary marketplace.

For instance, right here’s a quote for a 1-year Treasury at the secondary marketplace:

| Value | Yield | |

|---|---|---|

| Bid | 95.428 | 4.814% |

| Ask | 95.493 | 4.743% |

You get a yield of four.74% while you purchase (paying the ask value) however you should pay a yield of four.81% while you promote (receiving the bid value). The truthful worth is someplace in between. Assume it’s 4.77%, which means that you’re getting a yield of about 0.03% not up to the truthful worth while you purchase at the secondary marketplace.

Everybody will pay the similar value and will get the similar yield after they purchase a brand new difficulty. There’s no bid/ask unfold. It can be OK in the event you pay a bid/ask unfold as soon as to shop for a 10-year bond and dangle it for 10 years however in the event you pay a bid/ask unfold each 3 months, it provides up speedy.

Complicates Taxes

Whilst you purchase Treasuries in a taxable account, purchasing them at the secondary marketplace provides extra headaches on your taxes than purchasing new problems. You’ll wish to know what to do with gathered hobby and, if acceptable, amortizable bond top rate (see IRS Time table B Directions). They’re now not inconceivable to care for however it’s nonetheless additional paintings.

Promoting Treasuries in a taxable account at the secondary marketplace sooner than they mature provides but extra headaches on your taxes. If you happen to should purchase Treasuries at the secondary marketplace in a taxable account, a minimum of dangle them to adulthood and don’t promote them at the secondary marketplace.

Purchasing or promoting at the secondary marketplace in an IRA doesn’t impact your taxes.

Should Position Order When the Marketplace Is Open

Whilst you purchase a brand new difficulty, you wish to have to put your order all over an order window however you’ll be able to do it within the night or on weekends. You’re just right to head so long as your order is going in via the night time sooner than the public sale date.

Whilst you purchase at the secondary marketplace, you should position your order when the bond marketplace is open. That’s in most cases Monday via Friday, 8:00 a.m. to five:00 p.m. Japanese Time. This may increasingly intrude along with your agenda.

No Auto Roll

Some agents similar to Constancy and Charles Schwab be offering an non-compulsory “auto roll” function while you purchase new-issue Treasuries. If you happen to allow the function while you purchase, they’re going to mechanically position a brand new order for a similar time period and face worth when this Treasury matures. It’s particularly useful for momentary Treasuries.

This selection is handiest to be had for brand new problems. You’ll’t “auto roll” while you purchase at the secondary marketplace.

On-line Agents

If in case you have just right causes to shop for Treasuries at the secondary marketplace and you recognize and settle for the drawback, right here’s do it at some primary on-line agents. Click on at the hyperlink to leap without delay to the phase for the dealer you utilize — Constancy, Forefront, Charles Schwab, and Merrill Edge.

Constancy

Listed here are the stairs to shop for Treasuries at the secondary marketplace in a Constancy account. Constancy doesn’t rate charges for getting Treasuries at the secondary marketplace.

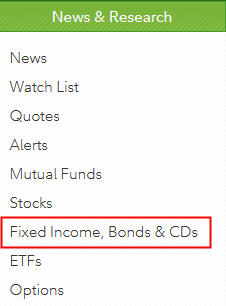

Below Information & Analysis at the best, click on on Mounted Source of revenue, Bonds & CDs.

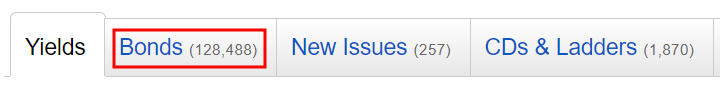

Click on at the Bonds tab.

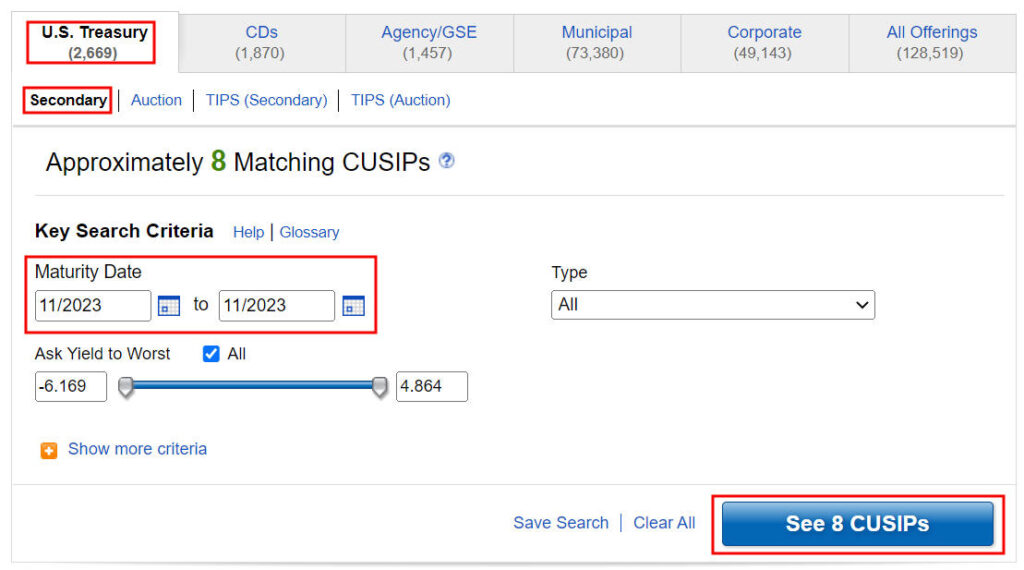

U.S. Treasury and Secondary are decided on via default. Assume you need a Treasury that matures in November 2023. Input the from-and-to months within the adulthood vary fields. The button tells you what number of Treasuries suit your seek. A CUSIP for bonds is just like the ticker image for shares.

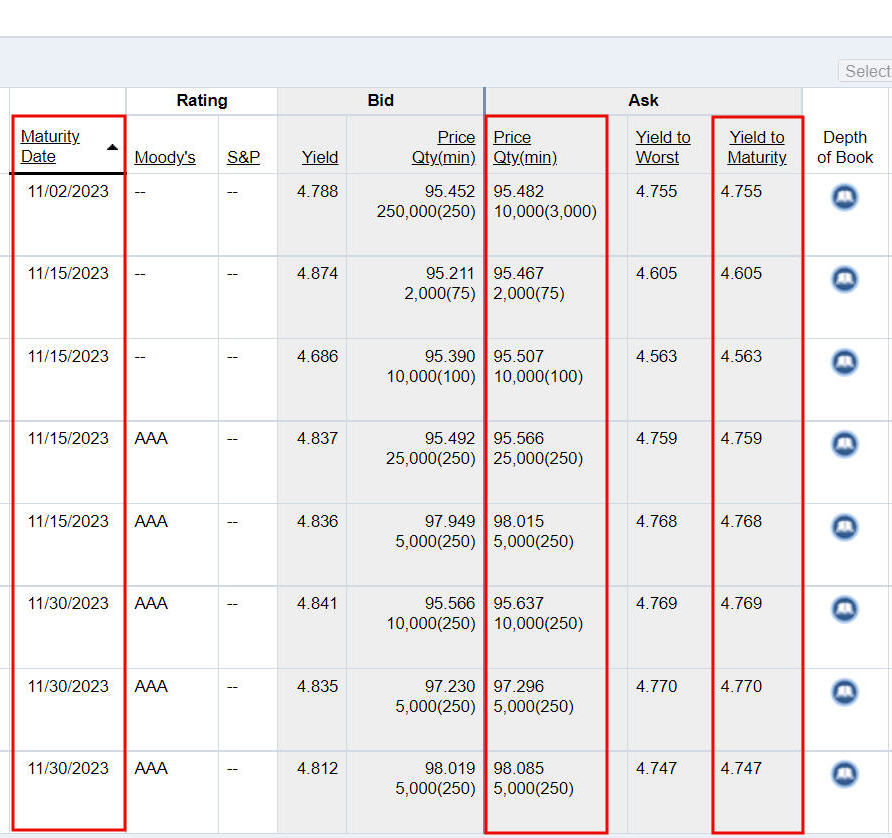

You notice a listing of Treasuries to be had. Have a look at the Ask columns while you’re purchasing. The Yield to Adulthood and Yield to Worst numbers are at all times the similar for Treasuries.

You received’t essentially get the quoted Yield to Adulthood on this desk as a result of the ones yields are for the minimal amount within the Value | Qty(min) column. For instance, you’ll have to shop for $3 million of face worth within the Treasury Invoice maturing on 11/02/2023 to get the 4.755% yield to adulthood (3,000 within the parenthesis manner $3 million as a result of 1 bond is $1,000 of face worth).

The $3 million minimal is handiest the minimal for the quoted value and yield. You’ll nonetheless purchase a smaller amount. You’ll simply must pay reasonably extra and get a reasonably decrease yield than a $3 million order.

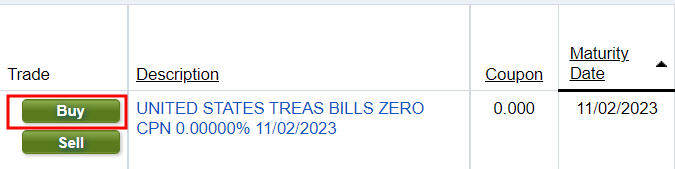

After scanning the effects desk, think you’re within the Treasury invoice that matures on 11/02/2023. Click on at the Purchase button subsequent to this Treasury.

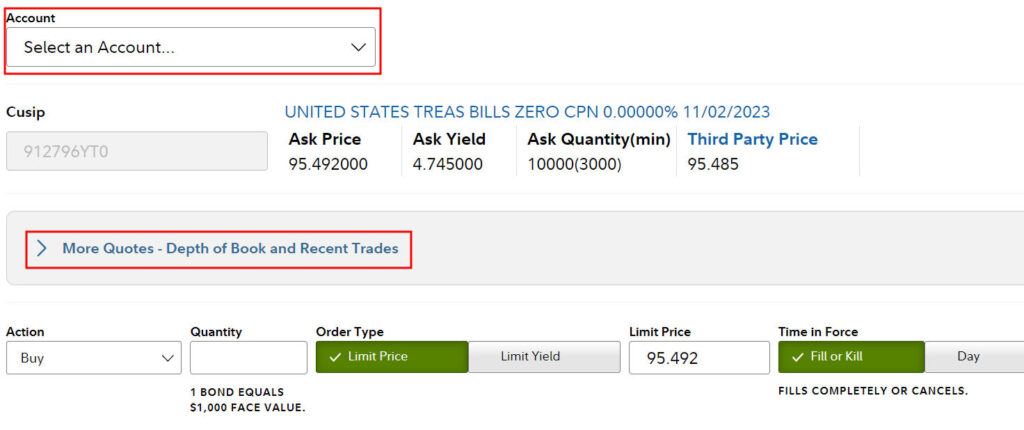

Click on at the Account dropdown to choose the account during which you’re going to purchase this Treasury. Click on on Extra Quotes – Intensity of Ebook and Fresh Trades to peer the associated fee and yield for the volume you’ll purchase.

Have a look at the Ask Costs while you’re purchasing. In finding the quote for the minimal amount you’re purchasing. If you happen to’re purchasing $10,000 face worth, you received’t get the associated fee and yield for the $3 million minimal or the $250,000 minimal. You’ll pay a reasonably upper value and get the yield for a $1,000 minimal order dimension, which is 4.740% within the screenshot.

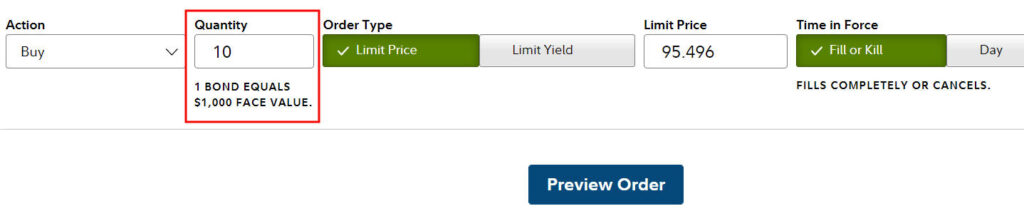

If you happen to’re glad with the quoted yield, input the volume you’d like to shop for. 1 bond is $1,000 face worth. To shop for $10,000 face worth, input a amount of 10. The minimal order dimension is 1 for $1,000 face worth.

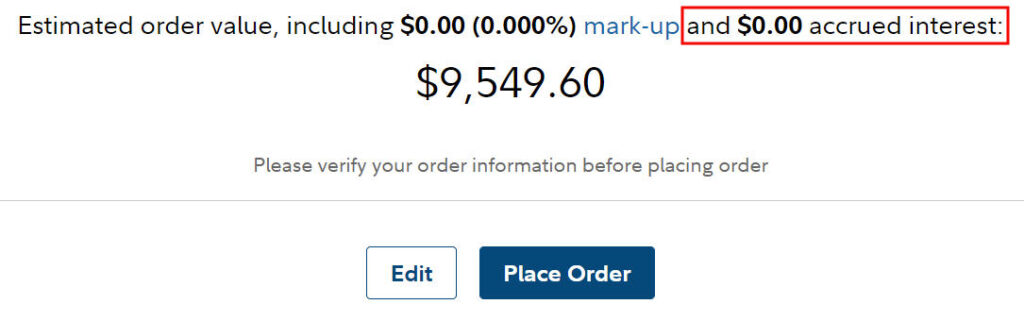

This ultimate display screen presentations how a lot you’ll pay for this order. The cash will come from your money stability and cash marketplace finances. Essential and hobby bills will mechanically pass into your money stability. You’ll’t “auto-roll” while you purchase at the secondary marketplace.

This explicit Treasury doesn’t have any gathered hobby however some others do. You pay the gathered hobby to the present proprietor and also you get it again within the subsequent hobby fee. If you happen to’re purchasing in a taxable account, you’ll have to bear in mind to subtract the gathered hobby while you do your taxes. In a different way you’ll pay extra taxes than you actually owe.

Forefront

Apply those steps to shop for Treasuries at the secondary marketplace in a Forefront brokerage account. Forefront doesn’t rate charges for getting Treasuries at the secondary marketplace.

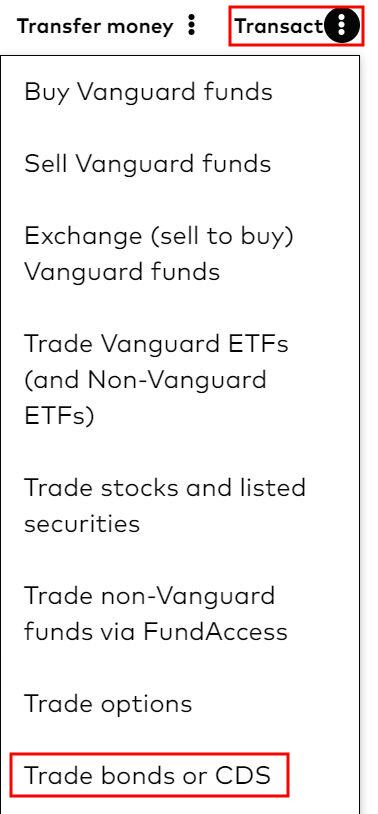

Click on at the 3 dots subsequent to Transact close to the highest proper of your account and scroll towards the ground. Click on on Business bonds or CDs.

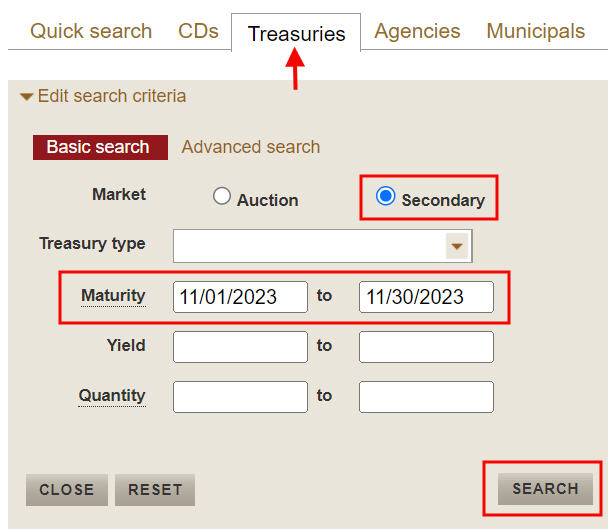

Click on at the Treasuries tab. The Secondary radio button is chosen via default. Input the variety of adulthood dates you’re fascinated by and click on on Seek.

You get a listing of to be had Treasuries. You’ll click on at the heading to kind via adulthood or yield. Have a look at the second one line in each and every row while you’re purchasing.

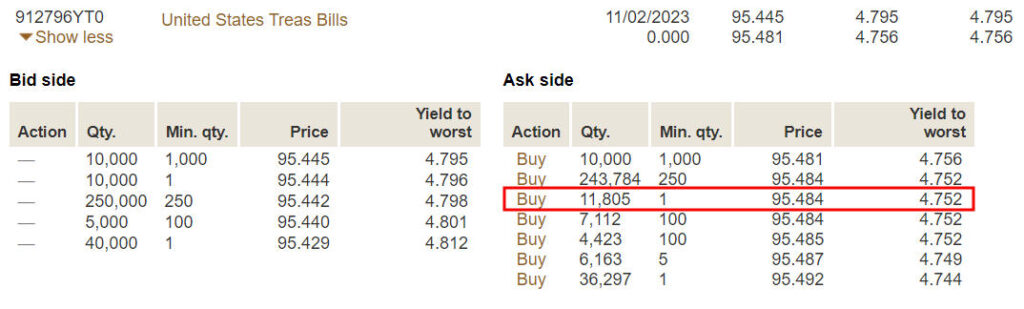

You received’t essentially get the quoted Yield to Adulthood on this desk as a result of the ones yields are for the minimal amount within the Min. qty column. For instance, you’ll have to shop for $1 million of face worth within the Treasury Invoice maturing on 11/02/2023 to get the 4.756% yield to adulthood (1,000 manner $1 million face worth as a result of 1 bond is $1,000 face worth).

The $1 million minimal is handiest the minimal for the quoted value and yield. You’ll nonetheless purchase a smaller amount. You’ll simply must pay reasonably extra and get a reasonably decrease yield than a $1 million order.

Assume you’re within the Treasury maturing on 11/02/2023. Click on on Display extra in that row.

Now you’re going to see the associated fee and yield for smaller orders. Have a look at the Ask facet while you’re purchasing. In finding the quote for the minimal amount acceptable to you. If you happen to’re purchasing $10,000 face worth, you received’t get the associated fee and yield for the $1 million minimal or the $250,000 minimal. You’ll pay a reasonably upper value and get the yield for a $1,000 minimal order dimension, which is 4.752% within the screenshot. Click on at the Purchase hyperlink subsequent to the acceptable minimal order dimension.

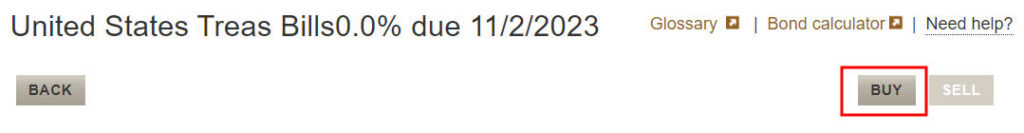

You’ll see a web page filled with details about this Treasury. Click on at the Purchase button in the event you’re nonetheless fascinated by purchasing it.

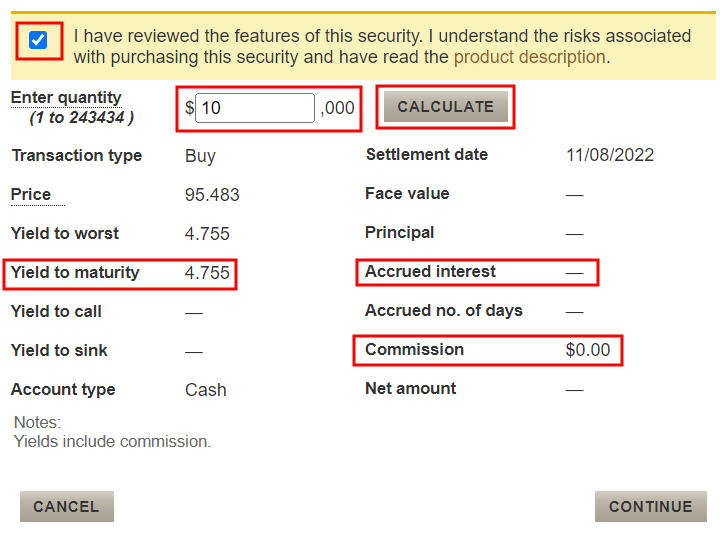

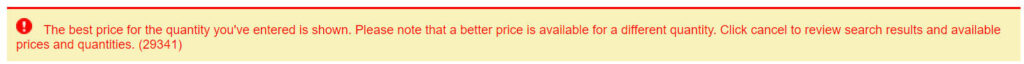

It’s a must to take a look at the field to mention what you’re doing. Input a amount of 10 to shop for $10,000 face worth. Click on on Calculate to peer the yield once more.

You notice a large caution at the best pronouncing you’re paying the next value to your small order. Not anything you’ll be able to do right here except you’ll be able to find the money for to shop for $250,000 or $1 million.

Now comes the general display screen sooner than you publish the order or cancel. You notice the yield, the gathered hobby if acceptable, and the online quantity that’ll come from your agreement fund. Essential and hobby bills will mechanically pass into your agreement fund. You’ll must reinvest the ones bills by yourself.

This explicit Treasury doesn’t have any gathered hobby however some others do. You pay the gathered hobby to the present proprietor and also you get it again within the subsequent hobby fee. If you happen to’re purchasing in a taxable account, you’ll have to bear in mind to subtract the gathered hobby while you do your taxes. In a different way you’ll pay extra taxes than you actually owe.

Charles Schwab

You’ll purchase Treasuries at the secondary marketplace in a Charles Schwab account as neatly. Schwab additionally doesn’t rate charges on purchasing Treasuries at the secondary marketplace.

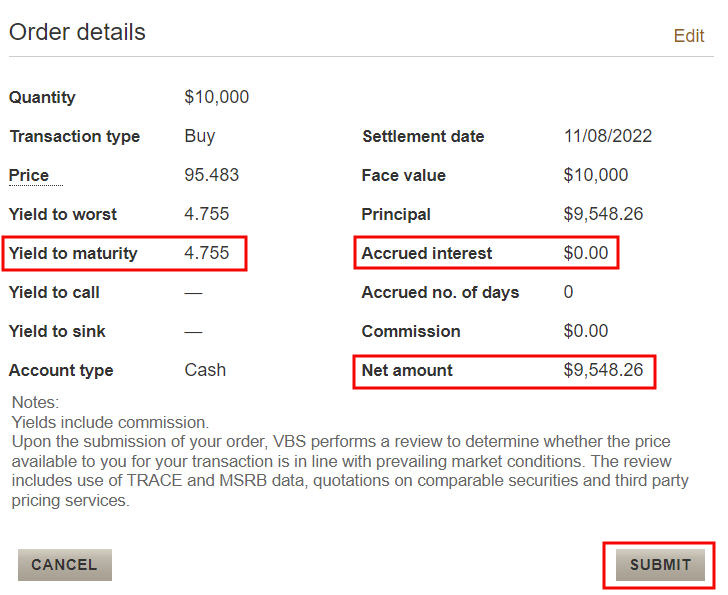

Click on on Business within the best menu after which In finding Bonds & Mounted Source of revenue.

I don’t have extra screenshots for Charles Schwab at this second however the procedure must be very similar to Constancy and Forefront. I’ll upload screenshots right here when I’ve them.

Merrill Edge

Purchasing new-issue Treasuries at Merrill Edge calls for a telephone name and a $30 price however you’ll be able to purchase Treasuries at the secondary marketplace on-line and not using a price.

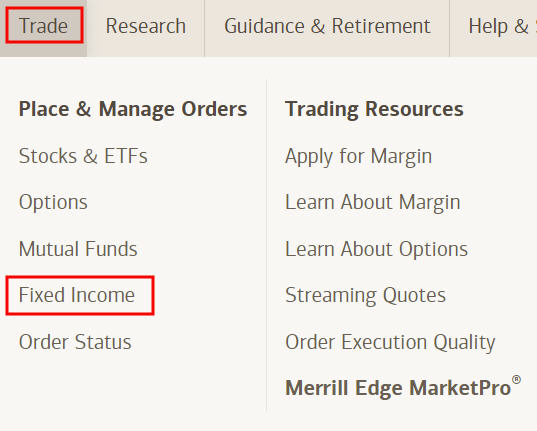

Click on on Business within the best menu after which Mounted Source of revenue.

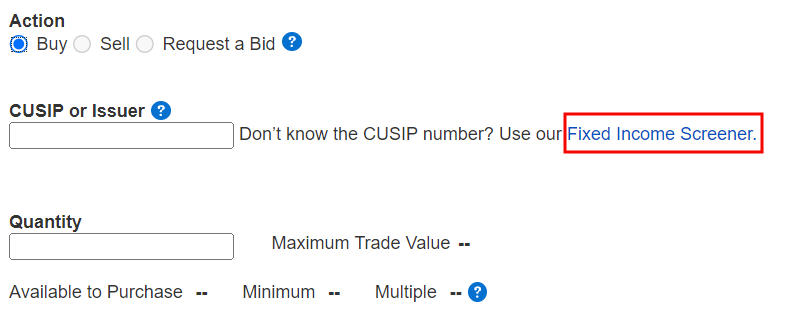

Click on at the Mounted Source of revenue Screener hyperlink to seek out the CUSIP for the Treasury you need. The CUSIP for a bond is just like the ticker image for a inventory.

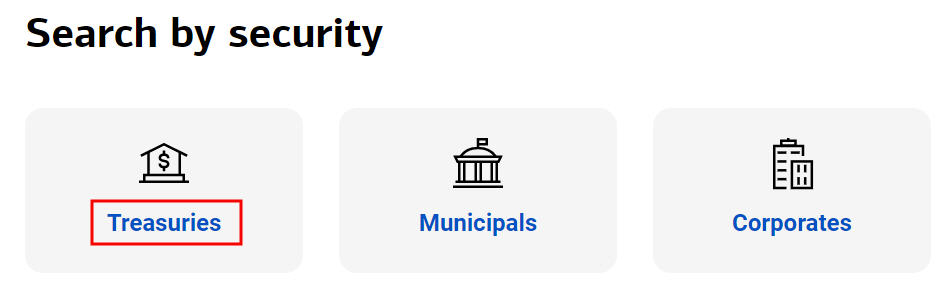

Click on on Treasuries.

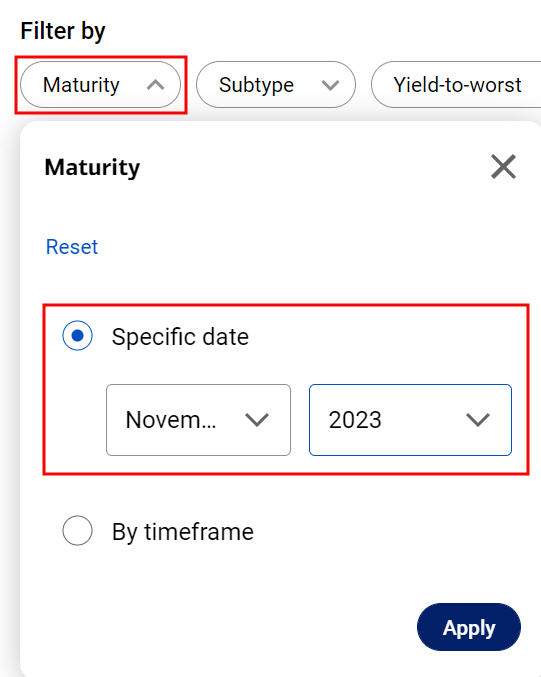

Assume you need a Treasury that matures in November 2023. Click on on Adulthood after which make a choice the month and the 12 months.

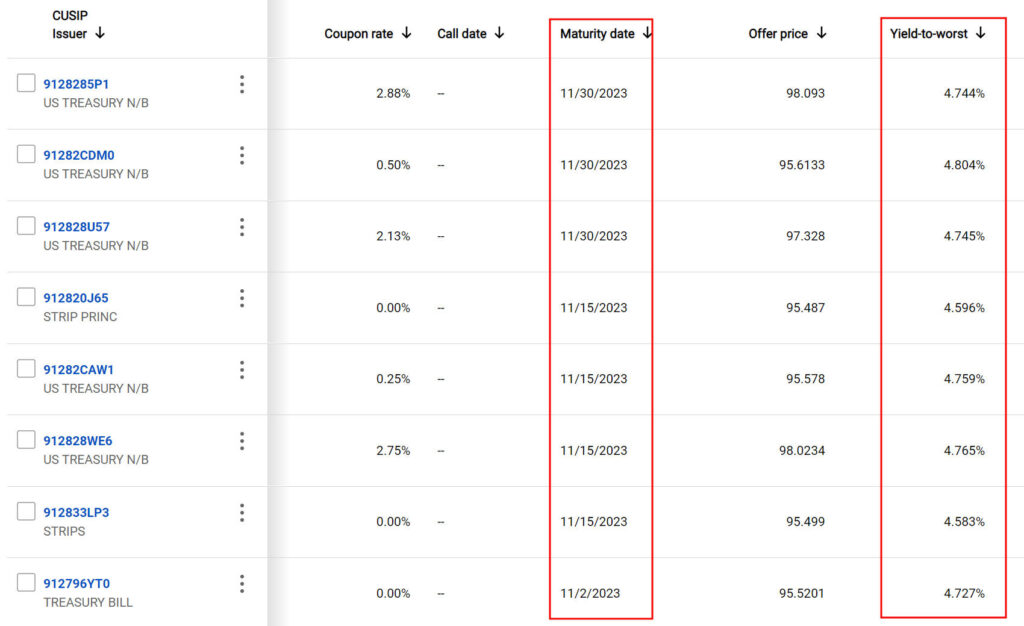

You get a listing of Treasuries that mature in that month. Click on on any heading to kind via that column. Yield-to-worst is the at all times identical as yield-to-maturity for Treasuries.

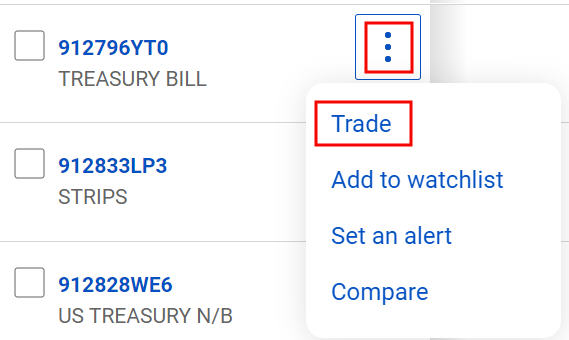

Assume you picked one in accordance with the adulthood date and the yield. Click on at the 3 dots subsequent to that Treasury after which click on on Business.

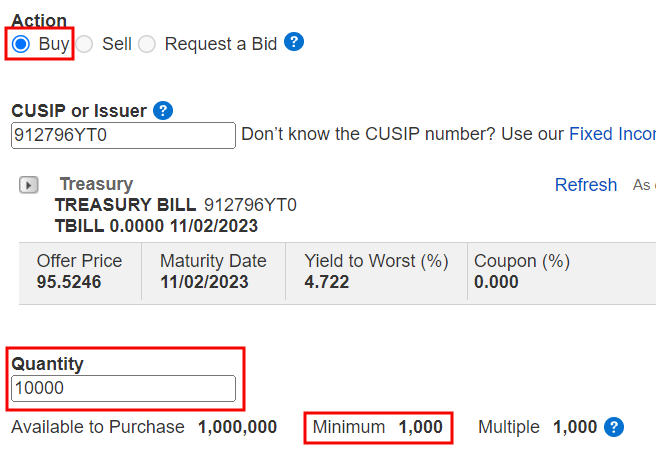

You’re again to the order access web page. Input the face worth you’d like to shop for below Amount. For instance, input 10000 in the event you’d like to shop for $10,000 face worth. The minimal order is $1,000 face worth for this one however from time to time the minimal may also be upper.

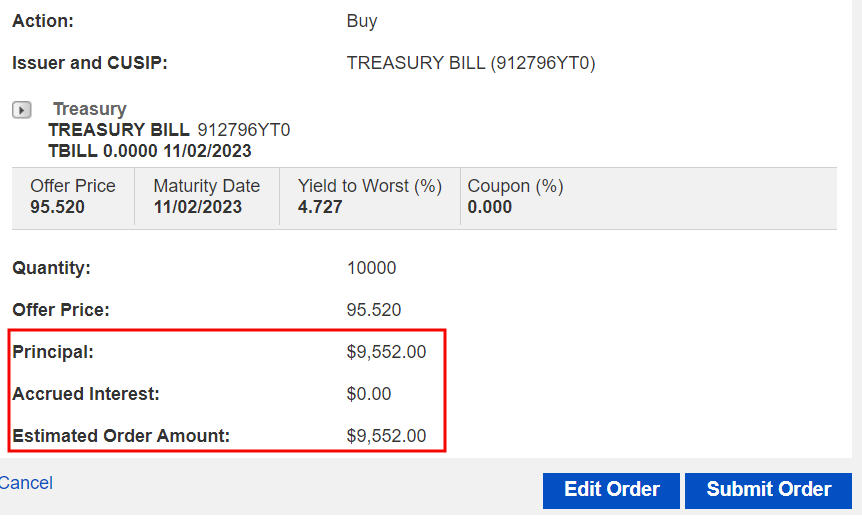

The overall evaluate web page presentations how a lot you’ll pay for this order. You notice the yield, the gathered hobby if acceptable, and the online quantity that’ll come from your money stability.

This explicit Treasury doesn’t have any gathered hobby however some others do. You pay the gathered hobby to the present proprietor and also you get it again within the subsequent hobby fee. If you happen to’re purchasing in a taxable account, you’ll have to bear in mind to subtract the gathered hobby while you do your taxes. In a different way you’ll pay extra taxes than you actually owe.

***

Purchasing Treasuries at the secondary marketplace fills gaps when the time period you need isn’t to be had as a brand new difficulty or when the following new-issue public sale is simply too a ways forward one day. It’s a viable choice if you recognize and settle for the drawback of shopping for at the secondary marketplace. Purchasing them in an IRA eliminates the tax headaches.

The wish to purchase at the secondary marketplace is particularly acceptable to TIPS as a result of new-issue TIPS don’t are available as many maturities as nominal Treasuries they usually pop out a lot much less ceaselessly.

Bond costs exchange via the minute. New problems received’t at all times have the next yield. If a brand new difficulty is popping out in a while, you could make a decision to attend, however you’ll be able to purchase at the secondary marketplace now and lock within the present yield if the public sale for the following new difficulty is moderately a ways forward.

Say No To Control Charges

If you’re paying an marketing consultant a proportion of your belongings, you might be paying 5-10x an excessive amount of. Learn to in finding an unbiased marketing consultant, pay for recommendation, and handiest the recommendation.