Learn how to Input 2022 ESPP Offered in FreeTaxUSA: Alter Value Foundation

In case your employer gives an Worker Inventory Acquire Program (ESPP), you must max it out. You come back out forward although you promote the stocks once you’ll. See Worker Inventory Acquire Plan (ESPP) Is A Implausible Deal.

After you promote the stocks from the ESPP, a part of the source of revenue will probably be integrated to your W-2. Then again, the 1099-B shape you obtain from the dealer nonetheless displays your discounted acquire value. This submit displays you how you can make the important adjustment to your tax go back the usage of FreeTaxUSA.

Don’t pay tax two times!

For those who use different tax instrument, please learn:

When to Record

Prior to you start, you should definitely perceive when you want to file. You file while you promote the stocks you purchased below your ESPP. For those who simplest purchased stocks however you didn’t promote throughout the tax 12 months, there’s not anything to file but.

Wait till you promote, however write down the overall per-share value (sooner than the cut price) while you purchased. For those who bought more than one occasions, write down for each and every acquire:

- The acquisition date

- The remaining value at the grant date

- The remaining value at the acquire date

- The selection of stocks you purchased

This knowledge is essential while you promote.

Let’s use this case:

You purchased 1,000 stocks below your ESPP on 9/30/20xx. The remaining value at the acquire date used to be $12 in line with proportion. The remaining value at the grant date six months sooner than used to be $10 in line with proportion. You purchased at $8.50 in line with proportion with the cut price.

You can write down:

| Grant Date | 4/1/20xx |

| Marketplace Value at the Grant Date | $10 in line with proportion |

| Acquire Date | 9/30/20xx |

| Marketplace Value at the Acquire Date | $12 in line with proportion |

| Stocks Bought | 1,000 |

| Discounted Value | $8.50 in line with proportion |

Stay this knowledge till you promote.

1099-B From Dealer

Whilst you promote, you’ll obtain a 1099-B shape from the dealer within the following 12 months. You’re going to file your acquire or loss the usage of this 1099-B shape and the guidelines you gathered for each and every acquire. Some agents will provide supplemental data on your purchases.

Let’s proceed our instance:

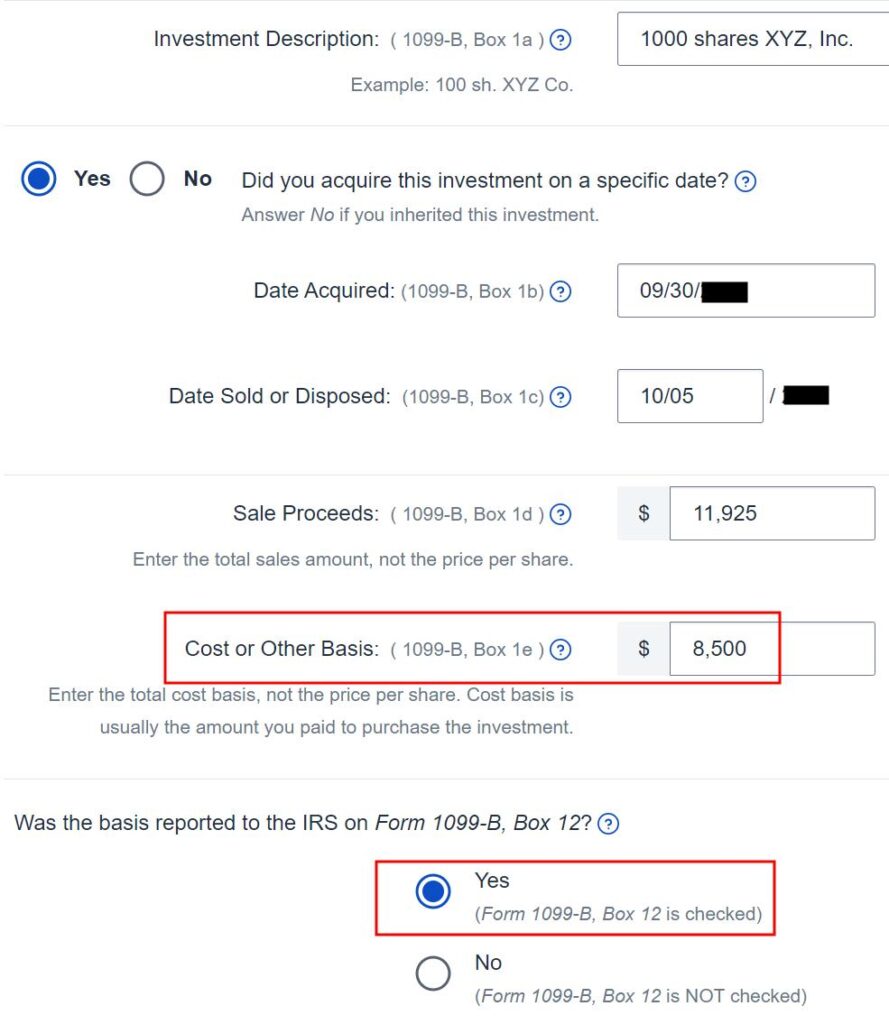

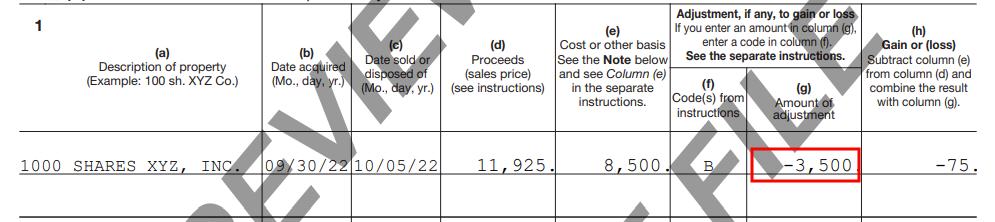

You bought 1,000 stocks out of your acquire above on 10/5/20xx at $11.95 in line with proportion. After fee and costs, you netted $11,925. You won a 1099-B shape out of your dealer appearing a gross sales continue of $11,925 within the following 12 months. The 1099-B shape displays the fee foundation as $8,500, which displays your discounted acquire value.

Since you didn’t grasp it for 2 years after the grant date and three hundred and sixty five days after the acquisition date, your sale used to be a “disqualifying disposition.” The cut price is added as source of revenue in your W-2. This raises your value foundation. For those who simply settle for the 1099-B as-is, you’ll be double-taxed!

FreeTaxUSA

Now let’s do it in FreeTaxUSA.

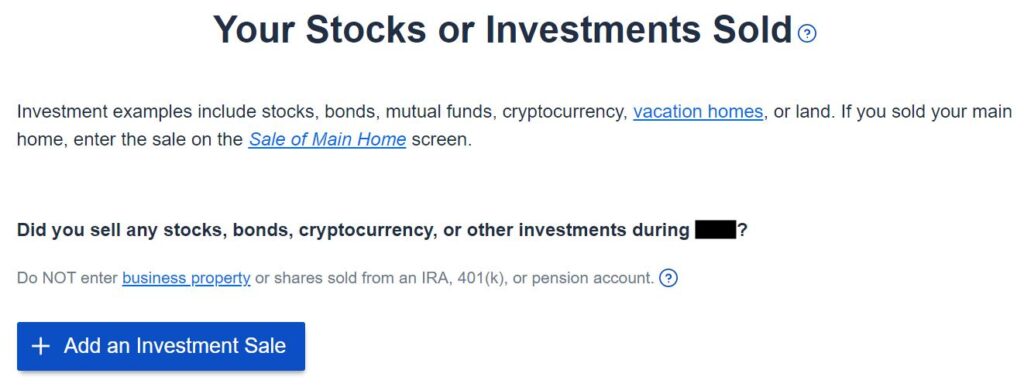

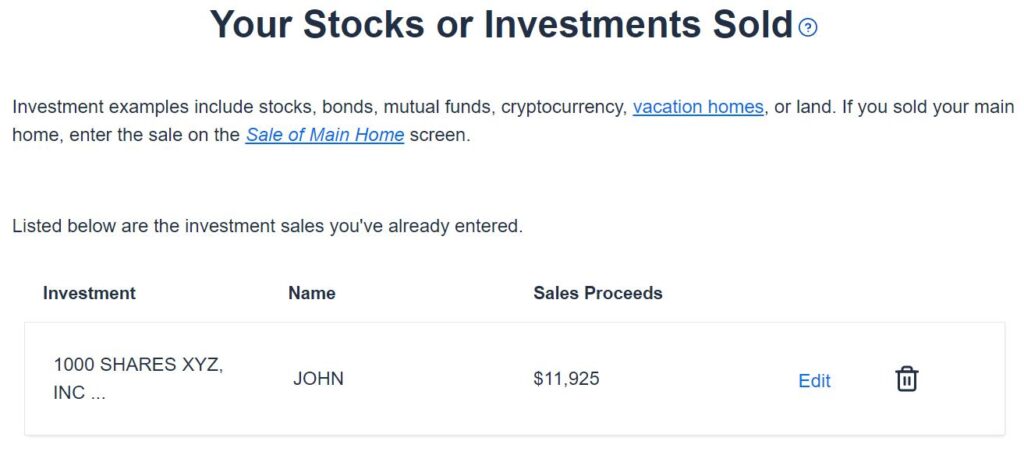

In finding “Shares or Investments Offered (1099-B)” within the “Commonplace Source of revenue” segment below “Source of revenue” within the menu. Click on on “Upload an Funding Sale.”

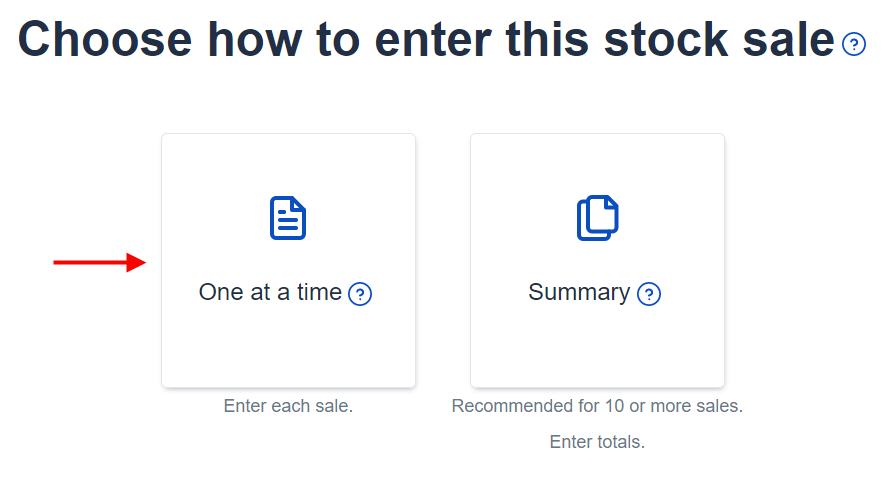

Make a selection “One after the other.”

Input the numbers to your 1099-B as they seem. The price foundation to your 1099-B used to be reported to the IRS but it surely used to be too low.

Don’t make any adjustments right here. Your dealer despatched this knowledge to the IRS. It has to compare.

Alter Value Foundation

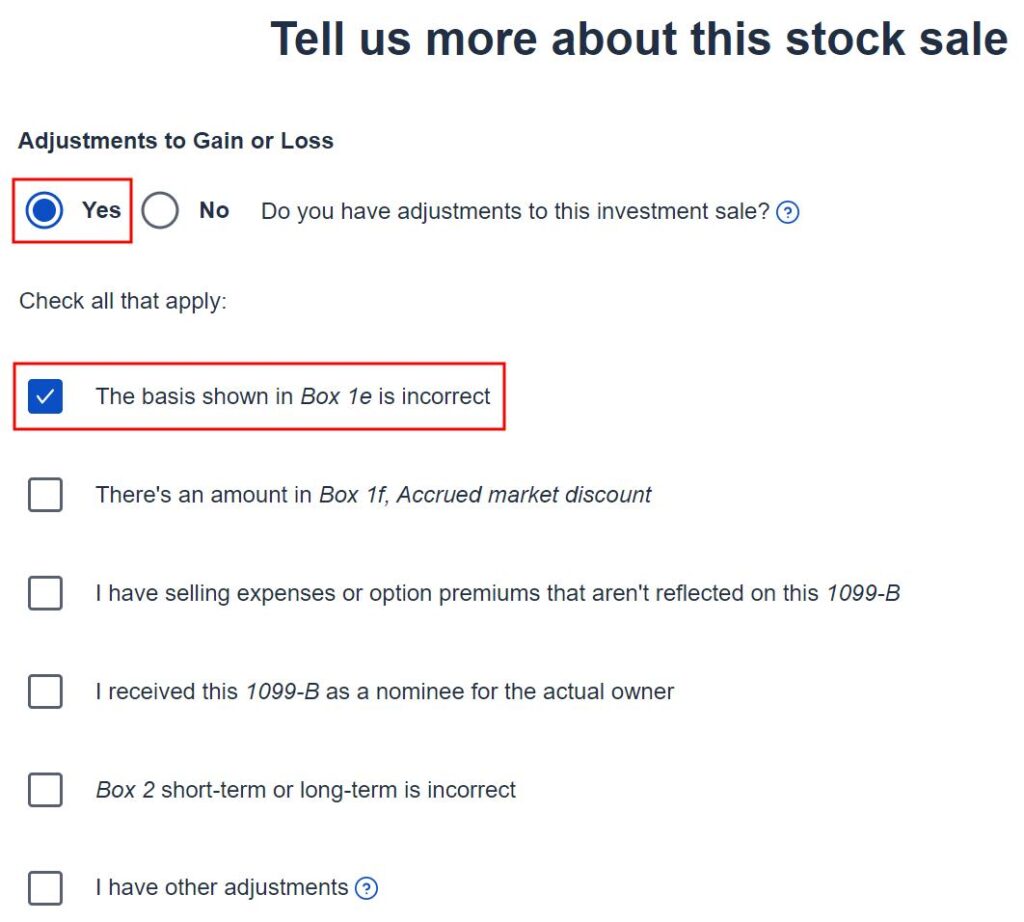

You’ve got this chance to make an adjustment. Test the “Sure” radio button and the field for “The root proven in Field 1e is flawed.”

Input your acquire value plus the volume added in your W-2. Whilst you did a “disqualifying disposition” your value foundation used to be the overall worth of the stocks at the date of the acquisition. The marketplace value used to be $12 in line with proportion while you bought the ones 1,000 stocks at $8.50 in line with proportion. Your employer added the $3,500 cut price as source of revenue in your W-2. Due to this fact your true foundation is $8,500 + $3,500 = $12,000.

For those who didn’t promote all of the stocks bought in that batch, multiply the selection of stocks you bought by way of the cut price value at the date of acquire and upload the cut price integrated to your W-2. For instance, in the event you bought simplest 500 stocks and your employer added $1,750 in your W-2, your corrected value foundation is:

$8.50 * 500 + $1,750 = $6,000

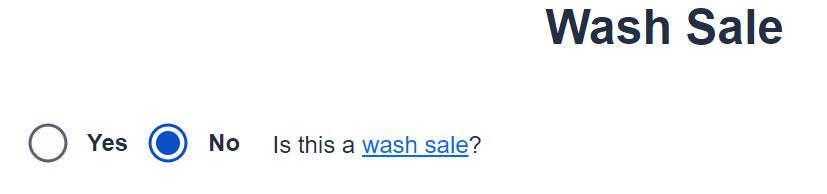

For those who had a wash sale, your 1099-B shape would point out it as such. We didn’t have a wash sale in our instance.

We’re accomplished with one ESPP sale. Repeat in the event you bought greater than as soon as throughout the 12 months.

Test on Shape 8949

We will be able to test that the adjustment makes it all of the option to the tax shape.

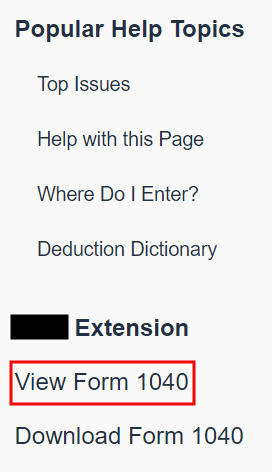

Click on on “View Shape 1040” at the proper.

Scroll down to search out Shape 8949 within the popup. You spot the detrimental adjustment in column (g).

For those who didn’t make the adjustment and also you simply approved the 1099-B as-is, you’ll pay capital positive factors tax once more at the $3,500 cut price you’re already paying taxes thru your W-2. Take note to make the adjustment!

Say No To Control Charges

In case you are paying an marketing consultant a share of your property, you’re paying 5-10x an excessive amount of. Discover ways to in finding an unbiased marketing consultant, pay for recommendation, and simplest the recommendation.