Is It Value Transferring to Decrease Price of Residing After You Retire?

I wrote in a prior put up Our Revel in in Development a House Over Purchasing an Current House that I constructed a brand new house. Through accident, the general all-in charge of this new house got here to about the similar as the web proceeds from promoting my earlier house in California 4 years in the past. That earlier house is value much more now. If I take a median of the estimated price from Zillow and Redfin, it’s value 50% greater than my new house.

As a area regardless that, the former house has not anything to check to the brand new house. It was once a tract area constructed within the Sixties with 1/3 of the residing area of my new house. Successive homeowners up to date it right here and there over 60 years however the construction was once nonetheless the unique.

How come a 60-year-old house is value 50% greater than a brand-new house 3 times its measurement? The price is clearly within the land. The land underneath that earlier house is value a minimum of 5 occasions the land underneath my new house even if the 2 items of land are of equivalent measurement.

When other folks discuss low-cost-of-living (LCOL) spaces, high-cost-of-living (HCOL) spaces, and very-high-cost-of-living (VHCOL) spaces, the adaptation in charge of residing is most commonly pushed by way of the price of housing. In any case, costs are the similar whilst you order stuff from Amazon. Groceries and gasoline would possibly charge a bit of extra in some puts however they don’t make up a big a part of spending. Why is housing so a lot more pricey in some puts than others?

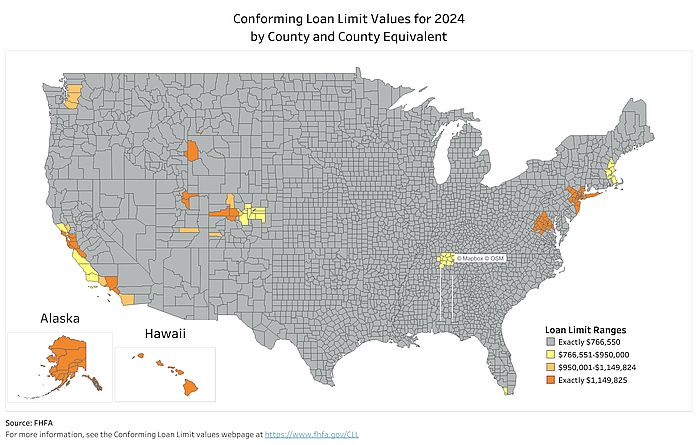

We get some clues by way of having a look at the place house costs are most costly within the nation.

Conforming Mortgage Restrict Map

The Federal Housing Finance Company (FHFA) units a buck prohibit on “conforming loans.” Mortgages underneath the conforming mortgage prohibit can also be bought to Fannie Mae and Freddie Mac. The mortgage prohibit is identical in maximum puts around the nation. It’s 50% upper in some wallet with excessive house costs. The conforming mortgage prohibit map displays the place those high-cost spaces are.

Supply: Conforming Mortgage Restrict Map, Federal Housing Finance Company

This map is going by way of counties. The darkish orange counties at the map have the best conforming mortgage prohibit within the nation, which is an indication of the best house costs.

- Alaska

- Hawaii

- Northern California close to San Francisco

- Southern California close to Los Angeles

- Two counties in Wyoming and Idaho close to Jackson, WY

- Two counties in Utah close to Park Town, UT

- 3 counties in Colorado close to Aspen, CO

- Washington D.C. and within reach spaces in Maryland, Virginia, and West Virginia

- New York Town and within reach spaces in New York, New Jersey, and Pennsylvania

- Two counties in Massachusetts close to Martha’s Winery

We see two subject matters from this record: main financial facilities and holiday spots.

Properties are costlier in main financial facilities however so are earning. I couldn’t have made it this a long way if I didn’t are living in a VHCOL house with ample good-paying jobs.

Properties are costlier in holiday spots as a result of other folks purchase 2nd houses there for his or her holidays and to hire to travelers.

For those who’re operating, is it value transferring to a VHCOL house for the next wage? For those who’re retired, is it higher to transport clear of a VHCOL house when jobs are not an element?

Price of Possession

Even supposing I mentioned a buy-or-rent calculator must be the closing step you are taking whilst you discover whether or not you must purchase or hire, it’s a useful gizmo to check the price of proudly owning a house in other places for the reason that calculator converts the quite a lot of prices of proudly owning a house to a unmarried rent-equivalent quantity. If proudly owning a house in a single position is equal to $4,000/month in hire and proudly owning a house in a special position is equal to $3,000/month in hire, we all know that housing within the first house prices $1,000/month extra.

I ran the New York Occasions buy-or-rent calculator with those assumptions for 3 houses in other places costing $500k, $1 million, and $2 million:

- Plan to stick in house: two decades

- Down cost: 100% (no loan)

- House value enlargement charge: 3%

- Hire enlargement charge: 3%

- Funding go back charge: 7%

- Inflation charge: 3%

- Belongings tax charge: 1% of house price

- Marginal tax charge: 25% (federal and state)

- Last charge to shop for: 0%

- Last charge to promote: 6%

- Repairs: $5,000 a yr

- House owner’s insurance coverage: $2,000 a yr

- Application lined by way of landlord if renting: $0

- Per 30 days commonplace charges: $0

- Commonplace charges deduction: 0%

- Safety deposit if renting: 1 month

- Dealer’s price if renting: $0

- Renter’s insurance coverage if renting: $150/yr

I set the upkeep charge and house owner’s insurance coverage to a set quantity for the reason that distinction in the house values in other places is essentially within the land. A pricey house in a VHCOL house doesn’t essentially charge extra to care for or insure.

Those are the rent-equivalent numbers for houses in 3 other puts underneath my assumptions above. Please re-run the numbers when you want a special set of assumptions.

| $500k House | $1 million House | $2 million House | |

|---|---|---|---|

| Price of Possession | $2,215/month | $3,939/month | $7,439/month |

The very first thing that jumps out from this workout is that the price of proudly owning a house unfastened and transparent isn’t most effective the valuables tax and upkeep. The most important charge of proudly owning a house and not using a loan is the chance charge of the cash tied right down to the house. Proudly owning a $2 million house in a VHCOL house prices a number of occasions greater than proudly owning a $500k house in a special house. See extra about this in Paying Off Loan Did Now not Decrease My Housing Price.

Underneath the assumptions above, a role seeker transferring from a space the place a house prices $500k to a space the place a house prices $1 million will want to make $1,700/month or $20k in keeping with yr extra after taxes to hide the upper charge of housing. A retiree transferring from the place a house prices $2 million to the place a house prices $1 million will save $3,500/month or $42k in keeping with yr from the lower price of housing.

The adaptation in housing prices is delicate to the assumed house value enlargement charge. If house costs in a VHCOL house develop sooner for the reason that house is a big financial heart or a well-liked holiday spot, it lowers the space in prices of possession. Listed here are the prices of possession with other house value enlargement charges:

| $500k House | $1 million House | $2 million House | |

|---|---|---|---|

| House Worth Enlargement | 3%/yr | 4%/yr | 4%/yr |

| Price of Possession | $2,215/month | $3,476/month | $6,492/month |

If house costs in a VHCOL house develop only one%/yr sooner, a $2 million house within the VHCOL house remains to be costlier to possess than a $500k house within the LCOL house, however it’s most effective 2.9 occasions as pricey, no longer 4 occasions. A 1% sooner enlargement charge reduces the space in prices of possession between a $1 million house and a $2 million house from $42k a yr to $31k a yr. 1% sooner enlargement lowers the space between a $500k house and a $1 million house from $20k a yr to $15k a yr. A 2% sooner enlargement will shrink the space by way of but extra.

While you’re operating, it’s value transferring to a VHCOL house when upper earning and higher profession alternatives quilt the upper charge of housing. That’s why housing prices extra in the ones puts.

For retirees, whether or not to transport out of a VHCOL house is in the end an approach to life selection. Sure, it should charge $30k or $40k extra in keeping with yr however when you’ve got circle of relatives there and you’ll be able to have the funds for it, it can be value it so that you can keep put. Residing in a spot you wish to have to are living in is the most important a part of retirement. However, when you aren’t too hooked up to a VHCOL house and also you have been there just for jobs, transferring to another position would possibly unlock $30k or $40k in keeping with yr on different issues which might be extra necessary to you.

I nonetheless like this tweet on the place to are living in retirement from Christine Benz, Director of Private Finance at Morningstar:

You pay attention so much concerning the distinction in state taxes however I believe the tax side is much overblown. We stored lower than $1,000/yr in state source of revenue tax after we moved from high-tax California to no-tax Nevada. It’s no longer value transferring to save lots of most effective $1,000 a yr. The adaptation in the price of housing is extra considerable. Working the numbers is helping you quantify it. You could make a choice to stick put or transfer to a spot nearer to circle of relatives, pals, actions, or a spot with the elements you favor. Quantifying the adaptation in housing prices is helping you are making an educated resolution.

In our case, we didn’t save a lot cash by way of transferring however we advanced our way of life. Lets’ve selected a special position with a lower price of residing however we love it right here. That makes it value it. Way of life comes first when you’ll be able to have the funds for it.

Say No To Control Charges

If you’re paying an guide a share of your belongings, you’re paying 5-10x an excessive amount of. Learn to to find an unbiased guide, pay for recommendation, and most effective the recommendation.