Ditch Banks — Pass With Cash Marketplace Price range and Treasuries

Banks and credit score unions be offering financial savings accounts and CDs. Agents reminiscent of Forefront, Constancy, and Charles Schwab be offering cash marketplace price range and Treasuries. They serve identical functions at a excessive degree. Each a financial savings account and a cash marketplace fund permit versatile deposits and withdrawals. Each CDs and Treasuries be offering a hard and fast rate of interest for a hard and fast time period.

| Banks and Credit score Unions | Agents | |

|---|---|---|

| Versatile Deposits and Withdrawals | Top Yield Financial savings Account | Cash Marketplace Fund |

| Fastened Time period | CDs | Treasuries |

Whilst maximum discussions on those merchandise from banks and agents focus on having FDIC insurance coverage or now not (see No FDIC Insurance coverage – Why a Brokerage Account Is Protected), many of us don’t understand that there’s a elementary distinction between the jobs banks and agents play. I discussed this distinction in my Information to Cash Marketplace Fund & Top Yield Financial savings Account. It’s value highlighting it once more.

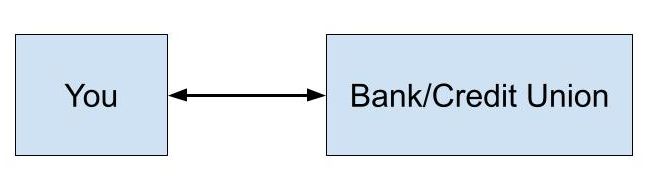

The basic distinction is that banks and credit score unions be offering a two-party non-public contract whilst a dealer serves as an middleman between you and the general public marketplace.

Two-Celebration Non-public Contract

A two-party non-public contract manner anything else is going so long as one celebration makes the opposite celebration comply with the phrases. If a financial institution will get you to comply with a nil.04% fee in a financial savings account or a nil.05% fee in a 10-month CD (those are precise present charges from a big financial institution), that’s what you’ll get without reference to what the speed will have to be. The financial institution units the speed. They don’t wish to justify it. You get a nasty contract should you aren’t acutely aware of the going fee.

A nasty contract doesn’t should be this obtrusive. It’s been over a yr now because the Fed raised the temporary rates of interest above 5%. The velocity on a “just right” on-line high-yield financial savings account reminiscent of the only from Best friend Financial institution is recently 4.2% whilst a cash marketplace fund will pay 5% or extra. It’s 4.2% from the financial institution simplest for the reason that financial institution says so. You’re paying a “familiarity penalty” whilst you stick with Best friend.

I’m now not selecting on Best friend particularly. It really works the similar at Marcus, Synchrony, Amex, Uncover, Capital One, or Barclays. Ken Tumin, the founding father of DepositAccounts.com, made this remark in April 2024:

If you are taking a step again and ask why banks can have the benefit of buyer inertia within the first position, you recognize that’s the character of a two-party non-public contract. Shoppers should take the initiative to wreck out of a nasty contract.

Some banks play tips by means of providing a brand new financial savings account beneath a unique identify with aggressive charges whilst conserving the speed low at the present financial savings accounts. The velocity is low at the present account simplest as a result of that’s the contract you agreed to. The financial institution isn’t obligated to transport you to the brand new program as a result of that’s now not within the contract. Nor does the financial institution must let you know that you’ll transfer to the brand new program to get a better fee. It’s as much as you in finding out and take motion.

Charges at many huge credit score unions aren’t any higher. I’m a member of a well-regarded credit score union. It’s the biggest credit score union within the nation by means of a long way, with thrice the property of the second-largest credit score union. The velocity on its financial savings account is 1.5% if in case you have $50,000 within the account. That’s 3.5% not up to the yield in a cash marketplace fund.

A just right contract nowadays can develop into a nasty contract the next day. How the contract will exchange is within the contract itself. A financial institution provides 5.0% APY on a 13-month CD nowadays. That’s an OK fee however what occurs after 13 months? You compromise within the contract it’ll routinely renew to a 12-month CD at a fee set by means of the financial institution at the moment until you are taking particular movements to forestall it inside of a brief window. Bet what fee the financial institution will set on its 12-month CD? Virtually all the time a nasty one. It really works this manner since you agreed to the contract.

When you’ve got a two-party non-public contract, your hobby is in direct struggle with the opposite celebration within the contract. The onus is on you to understand whether or not the contract is just right or unhealthy. It’s on you to observe when a just right contract becomes a nasty contract. Caveat emptor. You’ll have to leap from contract to contract should you don’t need to get caught in a nasty contract.

Some persons are extra alert in tracking and leaping. They’ve an opportunity to “beat the marketplace” however they pay for it with a heavy psychological workload and time spent on opening new accounts and shutting previous accounts. Many fail to be vigilant in the future. They begin paying the “familiarity penalty” as it’s too tiring differently.

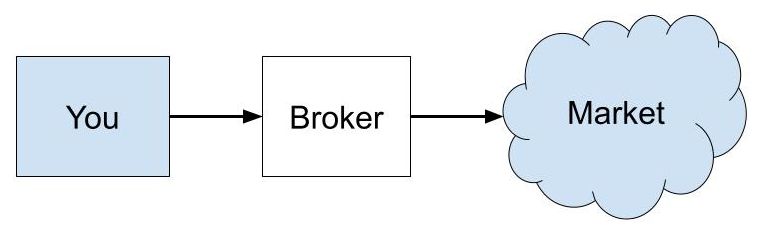

Marketplace Middleman

A dealer acts as an middleman. They get you the marketplace fee and take a reduce. A dealer doesn’t set the speed. The marketplace does. The dealer simplest units its reduce.

A cash marketplace fund will get you the marketplace fee on cash marketplace securities minus the reduce by means of the fund supervisor. Some fund managers take a larger reduce than others however the distinction between primary avid gamers is way smaller and extra strong than the variation between charges introduced by means of other banks and credit score unions. In case you use a cash marketplace fund with the smallest reduce, reminiscent of one from Forefront, you nearly ensure you’ll have the most productive fee in a cash marketplace fund all the time.

You continue to pay a “familiarity penalty” whilst you use a cash marketplace fund from Constancy or Schwab as opposed to one from Forefront however the distinction is within the 0.2%-0.3% vary while the “familiarity penalty” in financial institution financial savings accounts can also be greater than 1%. The “familiarity penalty” is 0 or negligible in purchasing Treasuries thru Constancy, Schwab, or Forefront.

Treasuries don’t trick you into renewing at a nasty fee. They routinely pay out at adulthood. You’ll get the marketplace fee whilst you purchase once more. If the dealer provides the “auto roll” characteristic and also you permit it at your selection, your Treasuries will routinely renew on the marketplace fee. You’ll leisure confident that you just gained’t be cheated.

Cash marketplace price range and Treasuries paid little or no when the Fed saved rates of interest at 0 and ran a number of rounds of Quantitative Easing a couple of years in the past. That wasn’t cash marketplace price range’ fault or agents’ fault. The ones have been the marketplace charges at the moment. Like making an investment in index price range, you surrender the dream of “beating the marketplace” whilst you put your cash in cash marketplace price range and Treasuries however you additionally persistently get the marketplace charges all the time. It doesn’t require conserving your guard up, tracking in moderation, or leaping.

If you wish to persistently earn a just right yield with low repairs, ditch banks and credit score unions. In case you most often stay cash in a financial savings account at a financial institution or a credit score union, put the cash in a cash marketplace fund at a dealer. Listed here are some alternatives at Forefront, Constancy, and Schwab:

Those are just right beginning issues. You’ll in finding extra money fund alternatives in Which Forefront Cash Marketplace Fund Is the Highest at Your Tax Charges, Which Constancy Cash Marketplace Fund Is the Highest at Your Tax Charges, and Which Schwab Cash Marketplace Fund Is the Highest at Your Tax Charges.

In case you most often purchase a CD from a financial institution or a credit score union, purchase a Treasury of the similar time period at Forefront, Constancy, or Schwab. See How To Purchase Treasury Expenses & Notes With out Charge at On-line Agents and The way to Purchase Treasury Expenses & Notes At the Secondary Marketplace.

I used to have many accounts with banks and credit score unions. I’ve simplest $60 in financial institution accounts now. My money is in cash marketplace price range and Treasuries in a Constancy brokerage account. Bank card payments routinely debit Constancy at the due date. Constancy routinely sells a cash marketplace fund to hide the debits. See 2 Tactics to Use Constancy as a Financial institution Account.

The Fed has signaled that they are going to decrease rates of interest quickly. I don’t suppose they are going to reduce charges all of the as far back as 0 once more. If at some point banks and credit score unions get started paying extra on their financial savings accounts and CDs than cash marketplace price range and Treasuries, which I doubt will occur, I can nonetheless stick with cash marketplace price range and Treasuries as a result of I just like the transparency and equity. I’d relatively get the marketplace fee all the time than depend at the benevolence of a financial institution or a credit score union.

Say No To Control Charges

If you’re paying an guide a share of your property, you’re paying 5-10x an excessive amount of. Learn to in finding an unbiased guide, pay for recommendation, and simplest the recommendation.