Constancy Retirement Making plans Instrument: Top-Degree Style, No longer Tactical

I got here around the Constancy retirement making plans calculator 3 years in the past after I met with a Constancy worker at their department workplace. Her identify was once Vice President, Monetary Marketing consultant. She defined to me that, on the VP point, she didn’t have a demand of getting purchasers use Constancy’s paid wealth control products and services. Part of her function was once to assist purchasers with monetary making plans.

Her number one instrument was once the retirement making plans instrument in Constancy’s Making plans and Steering Heart, which is to be had free of charge to all Constancy prospects. Non-customers too can sign up a visitor login and use it free of charge.

You’ll run the instrument by yourself with out operating with anyone at a Constancy department workplace. Constancy workers there assist folks run the instrument and search for up-selling alternatives.

Constancy’s Making plans and Steering Heart additionally has gear for different objectives corresponding to saving for school and purchasing a house. I best used the retirement making plans instrument. The fundamental concept is that you’ve got some source of revenue, some investments, and a few bills, and the instrument tells you the way smartly your source of revenue and investments will duvet your deliberate bills.

I performed with the retirement making plans instrument 3 years in the past. I used it once more just lately, and right here’s an replace on how smartly it really works.

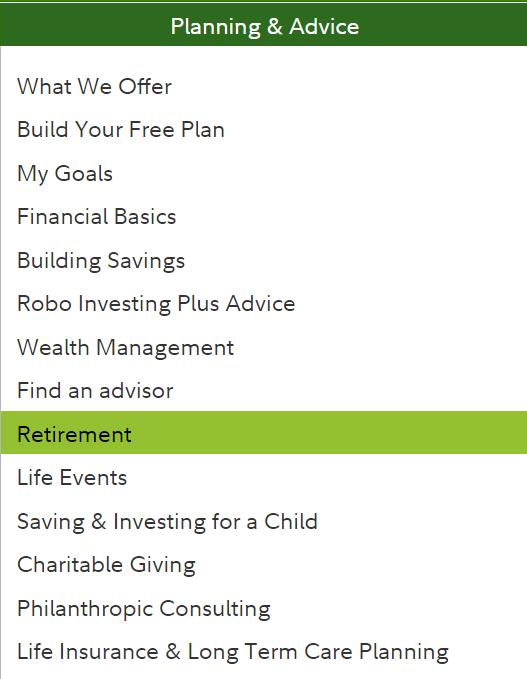

To get began, click on on “Making plans & Recommendation” on the best, after which “Retirement.”

In finding the “Get began” button in the course of that web page.

If it’s the primary time you’re the use of the instrument, it’ll ask you a chain of questions: age, gender, whilst you plan to retire, lifestyles expectancy, source of revenue, bills, and so on. It jumps into your present plan after you utilize it as soon as.

Source of revenue

If you happen to’re nonetheless operating, the employment source of revenue is believed to proceed till your deliberate retirement age. If you happen to’re self-employed, cut back your source of revenue by means of 1/2 of the self-employment tax to account for the upper taxes.

You’ll additionally upload one-time and episodic source of revenue assets corresponding to an inheritance, downsizing your house, part-time paintings, leases, and so on.

If you happen to aren’t receiving Social Safety but, you want to inform the calculator whilst you’ll declare Social Safety and what your advantages can be in these days’s bucks. See Retiring Early: Impact On Social Safety Advantages for get your income information from Social Safety and feed them into different gear to calculate your advantages.

Investments

All of the funding accounts you have got in Constancy Complete View are routinely populated within the retirement making plans instrument. See the former submit Constancy Complete View & GPS: Observe Your Portfolio Throughout All Accounts on use Complete View. You’ll exclude some accounts by means of unchecking them in the event that they’re now not supposed for retirement.

You’ll upload non-Constancy accounts manually within the retirement making plans instrument itself with out the use of Complete View, but it surely’s higher so as to add them in Complete View as a result of Complete View updates them routinely. If you happen to upload accounts manually within the retirement making plans instrument, you will have to refresh them one after the other to the present price whilst you run the retirement making plans instrument subsequent time.

Those accounts must best be monetary belongings that may be liquidated in part. If you happen to’re making plans to promote a condominium or a trade to fund your retirement, input the expected sale within the source of revenue segment.

Bills

If you happen to give only one quantity as your estimated bills in retirement, the making plans instrument assumes it’ll be that quantity once a year adjusted for inflation. It’s good enough in the event you’re some distance clear of retirement but it surely’s almost certainly too simplistic whilst you’re with reference to retirement or already retired.

Opting for “Detailed Bills” opens up a worksheet.

The detailed expense worksheet is damaged into too many classes in my view. You lose sight of the large image whilst you’re slowed down by means of whether or not your utilities are in reality $200 a month or $250 a month.

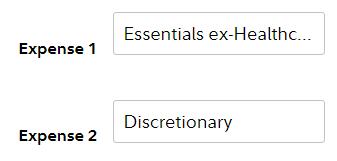

I recommend best the use of the healthcare portion after which going to “Customized Bills.”

You continue to fill out the healthcare portion since the making plans instrument offers healthcare bills the next inflation adjustment than it does for different bills.

I might installed simply two customized bills but even so healthcare: Necessities ex-Healthcare and Discretionary Bills. Those are the bottom bills that may ultimate all the way through retirement.

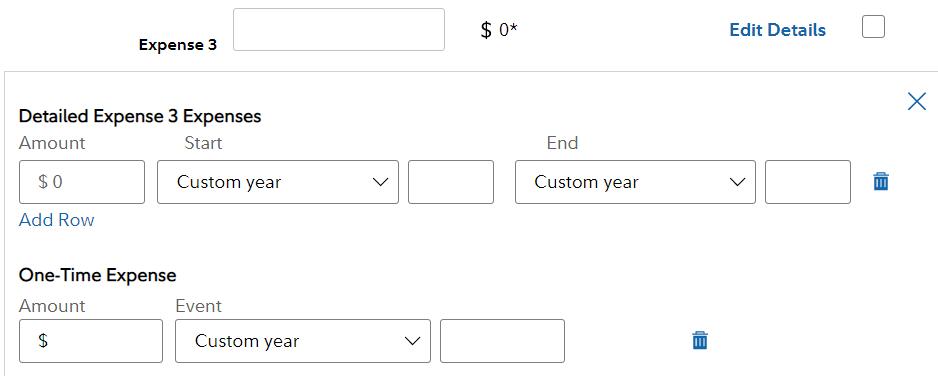

Then you’ll upload your spike and one-time bills, corresponding to house development, faculty tuition, further price range for go back and forth within the preliminary years of retirement, serving to kids with a down cost, and so on. Those bills have a get started yr and an finish yr.

Taxes

This making plans instrument best makes use of an estimated tax fee according to the projected gross taxable source of revenue for a given yr, your tax submitting standing, and your state of place of abode. It doesn’t carry out detailed tax calculations. Nor does it carry out Roth conversions to make the most of low tax years.

There’s an enter box for native taxes, which you’ll repurpose to type upper taxes.

Projections

After you input all of the knowledge, the retirement making plans instrument runs 250 simulations according to ancient returns. Via default, it makes use of the present asset allocation for your accounts.

The Hypothetical Belongings chart is extra fascinating to me. It offers 3 situations for marketplace returns: Considerably Under Moderate, Under Moderate, and Moderate. Considerably Under Moderate says 90% of ancient returns will finally end up above this quantity. Under Moderate is 75%, and Moderate is 50%.

The instrument suggests you have a look at the Considerably Under Moderate situation for conservative making plans. In case your source of revenue and belongings are enough to hide your deliberate bills when the longer term returns are above the ground 10% of ancient returns, your source of revenue and investments have a excellent probability to hide your deliberate bills.

You must save a record now earlier than you discover additional. This serves as your baseline situation.

Discover What-If’s

Whether or not your baseline says you’ll finally end up with $15 million whilst you die otherwise you’ll have a shortfall, you must discover some what-if’s to peer how other inputs have an effect on your result.

What in the event you paintings longer or retire faster?

What in case your bills are upper or decrease?

What if the spike and one-time bills are upper or decrease?

What if you are going to buy a 2nd house? What in the event you promote that 2nd house?

What in the event you declare Social Safety previous or later?

What if taxes are upper? Use the native tax box to dial up taxes.

The purpose of the workout is to know the way a lot leeway you have got in each and every enter. If you happen to see you have got a large number of leeway in a single space, you’ll calm down slightly and now not fear an excessive amount of about it. If you happen to see you have got very small leeway in any other space, that’s the place you must pay shut consideration.

You achieve a contented medium by means of trial and mistake in changing your inputs. Your purpose isn’t to depart an excessive amount of cash at the back of whilst you die but additionally to have enough cash to hide your bills whilst you reside lengthy.

I recommend the use of age 100 because the time horizon however best taking a look on the asset price at a extra affordable outdated age, say 88. Funding returns compound exponentially over a very long time horizon. The top asset price simply grows to an enormous quantity at age 100. The price at age 88 is extra practical.

You save any other PDF record whilst you to find your satisfied medium. That’s your progressed plan over your preliminary baseline.

Asset Allocation

Via default, the making plans instrument makes use of your precise asset allocation from the holdings for your accounts. You’ll additionally make it use certainly one of 9 type portfolios starting from 100% momentary investments to 100% shares.

This turns into any other what-if variable. You practice how making an investment otherwise impacts your retirement. If it doesn’t make that a lot distinction whether or not you make investments 50% in shares as opposed to 60% in shares, possibly you gained’t wish to obsess about your actual asset allocation.

Cushy Promote on Annuity

The ultimate segment of the retirement making plans instrument suggests the use of a portion of your portfolio to shop for an source of revenue annuity.

The idea is that after extra of the deliberate bills are coated by means of assured source of revenue streams, a portfolio can maintain extra withdrawals when returns are low. The idea isn’t essentially improper however an automatic advice according to best tough estimates seems like a comfortable promote to me.

I might forget about the Source of revenue Technique segment on the finish.

What It Doesn’t Do

I might name this a retirement modeling instrument. It’s helpful to type other inputs however don’t deal with the output as a tactical motion plan that guides your retirement year-by-year.

It doesn’t inform you when you’ll retire in the event you’re nonetheless operating. You’ll’t say I’d like to hide 120% of my deliberate bills (giving some margin for error), inform me when I will be able to prevent operating. You’d must do trial-and-error to derive it.

It doesn’t inform you how a lot you’ll spend. In case your deliberate bills are low, the instrument will display that you just’ll have some huge cash left on the finish. You’d must dial your bills up and down by means of trial and mistake and notice how a lot you’ll spend with out leaving an excessive amount of cash at the back of or risking working out of cash.

It doesn’t recommend an asset allocation. You’ll trade the objective asset allocation and notice what distinction it makes however the instrument gained’t inform you that given your source of revenue and belongings, this asset allocation will duvet the absolute best bills when long run returns are considerably beneath moderate.

It doesn’t trade the asset allocation over the years. This making plans instrument assumes that the asset allocation will keep the similar for all years. It doesn’t follow a waft trail to scale back your possibility as you progress alongside.

It doesn’t type inflation. The making plans instrument assumes 2.5% annual inflation for all bills apart from healthcare. You’ll’t trade that assumption.

It doesn’t type dynamic spending. The making plans instrument will use the given bills adjusted for inflation irrespective of the marketplace situation. It gained’t cut back your withdrawals when the marketplace is down.

It doesn’t arrange withdrawals for taxes. The instrument follows a preset order of withdrawals from other account varieties (taxable first, then pre-tax, and in any case Roth). It doesn’t arrange the withdrawals to clean out taxes.

It doesn’t type Roth conversions. You’ll’t inform the instrument so as to add an quantity for Roth conversions between age X and age Y.

To the level that you’ll withdraw much less when the marketplace is down or arrange your taxes higher thru withdrawal sequencing or Roth conversions, your outcome can be higher than the instrument presentations.

Conclusion

This loose retirement modeling instrument from Constancy can also be helpful in appearing you the way a lot leeway you have got and what strikes the needle and what doesn’t. Built-in with Complete View saves you time in updating your asset values.

Via some rounds of trial and mistake, you’ll make it display you when you’ll retire for a given expense price range or how a lot expense your belongings can duvet for a given retirement date in several marketplace stipulations. You’ll additionally see the impact of portfolio asset allocation by means of choosing other goal allocations. It’s helpful to ascertain some high-level obstacles.

It isn’t designed to come up with year-by-year tactical steerage in structuring your retirement withdrawals or Roth conversions.

Say No To Control Charges

In case you are paying an consultant a share of your belongings, you might be paying 5-10x an excessive amount of. Learn to to find an impartial consultant, pay for recommendation, and best the recommendation.