Absolute best Position for Prime Hobby Financial savings?

SaveBetter swimming pools high-interest financial savings accounts and CDs from monetary establishments national, giving consumers get admission to to high-yield accounts they differently wouldn’t learn about. However is SaveBetter one of the best ways to protected the most efficient financial savings charges? I solution that query and extra on this SaveBetter overview.

If this previous yr has taught us the rest, it’s that investments that appear too just right to be true virtually at all times are. Many buyers have been burned through ‘can’t pass over’ tech shares and may solely watch as the worth of virtual belongings, like cryptocurrencies and NFTs, evaporated in mins and couldn’t maintain the promised excessive returns.

In a extremely risky marketplace, deciding how one can make investments your cash is as difficult as ever, which is why emerging rates of interest have led many buyers towards the security of financial savings accounts and Certificate of Deposit (CDs).

That is the place SaveBetter is available in.

SaveBetter swimming pools high-interest financial savings accounts and CDs from monetary establishments national, giving consumers get admission to to high-yield accounts they differently wouldn’t learn about.

However is SaveBetter one of the best ways to protected the most efficient financial savings charges? I’ll solution that query and extra on this SaveBetter overview.

What Is SaveBetter?

SaveBetter LLC is a monetary generation corporate based in past due 2020 as a subsidiary of Deposit Answers, now Raisin DS. Raisin works with over 400 banks in additional than 30 international locations international.

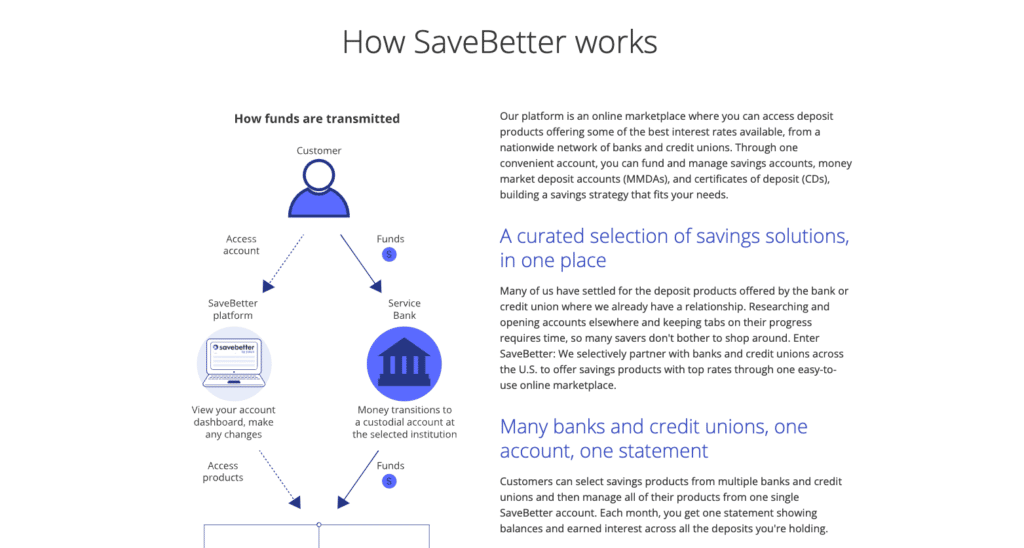

What makes SaveBetter distinctive is that it’s a virtual platform, no longer a standard financial institution. SaveBetter claims to offer a virtual “storefront” for banks and credit score unions having a look to advertise deposit merchandise to a bigger target market.

Since the SaveBetter platform promotes merchandise from lesser-known monetary establishments, buyers can benefit from gives they won’t have had get admission to to differently.

Consumers can make a choice from financial savings merchandise from FDIC-protected banks and NCUA-insured credit score unions that provide awesome rates of interest.

Key Options

| Account sorts | Financial savings accounts, Cash marketplace accounts, CD accounts, No-penalty CDs |

| Charges | None |

| Deposit Insurance coverage | Sure |

| Buyer Carrier Choices | Electronic mail, telephone |

| Buyer Carrier Telephone Quantity | 844-994-EARN (3276) |

| Internet/Desktop Get admission to | Sure |

| Cellular App Availability | No |

SaveBetter Merchandise

With SaveBetter, you’ll simply find financial savings merchandise from a number of monetary establishments to be sure to’re incomes the most efficient conceivable yield.

You’ll additionally get admission to your financial savings accounts and investments beneath one dashboard, For instance, it is advisable to have a two-year fixed-term CD on your wedding ceremony financial savings and a high-yield financial savings account on your emergency fund, and consider them each at the similar dashboard.

Prime-Yield Financial savings Account. A conventional financial savings account without a limits on deposits and withdrawals. Permits you to earn a better rate of interest whilst having consistent get admission to to budget when you wish to have it.

Cash Marketplace Deposit Account (MMDA). A cash marketplace account is a kind of financial savings account at a financial institution or credit score union that allows you to earn curiosity in your cash and make withdrawals.

No Penalty CD. Lock in a lovely price for a suite length being able to make an entire withdrawal at any level after the primary seven calendar days of investment your account with out paying the penalty. CD yields are typically upper than financial savings accounts.

Fastened-Time period CD. Your cash is held for a set length with a aggressive APY that permits a predictable and protected go back in your cash. Fastened-term CDs be offering upper charges than financial savings accounts and no-penalty CDs, however your cash is locked in all through the time period, i.e., 1 Yr, 3 Years, or 5 Years.

Is SaveBetter Reliable?

SaveBetter is a legitimate strategy to make investments. Even if SaveBetter isn’t a financial institution, your deposits with them are secure as much as $250,000 with FDIC coverage for financial institution merchandise and NCUA protection for credit score union merchandise.

SaveBetter may be a SOC 2-certified platform, they usually use different safety protocols, together with multi-factor authentication, encryption, and complex web coverage from Cloudflare.

Whilst there aren’t as many SaveBetter Critiques on-line as you can to find with extra established banks, it’s most probably that the provider simply hasn’t been round for lengthy sufficient.

How you can Get Began With SaveBetter

Right here’s how you’ll get began with SaveBetter:

Step 1: Create your account.

Arrange an account along with your distinctive username and password in 3-5 mins. It’ll ask you for a similar knowledge required when signing up for any roughly monetary product.

Step 2: Evaluation the other funding choices.

As soon as your account has been activated, it’s time to check the quite a lot of funding gives at the primary web page. You’ll make a choice from high-yield financial savings accounts, fixed-term CDs, and no-penalty CDs. You’ll understand quite a lot of merchandise from other monetary establishments, so you’ll store round till you to find probably the most horny be offering on your state of affairs. You’ll additionally discover those choices ahead of growing your account.

Step 3: Practice for gives.

You’ll follow for any FDIC-insured product indexed at the platform. SaveBetter additionally permits you to mix’n’match on the subject of the other establishments and choices to be had. For instance, you’ll spend money on a high-yield saving account with 3rd Coast Financial institution and a fixed-term CD presented via Ponce Financial institution.

Step 4: Fund your account.

When you’re able to buy an funding in line with your monetary targets and liquidity personal tastes, you are going to fund your account through connecting an current checking or financial savings account via Yodlee (a third-party app), or manually inputting your routing and account quantity on your present banking setup.

From there, it takes about 3 trade days for the switch to head via. You’ll get started amassing curiosity in your cash when the switch hits your SaveBetter account.

Step 5: Arrange your other making an investment accounts beneath one dashboard.

With SaveBetter, you’ll arrange your entire accounts beneath a unmarried dashboard. For additonal simplicity, you’ll solely get one tax record from SaveBetter, although you make investments with a couple of monetary establishments.

SaveBetter Execs and Cons

As with all monetary instrument, there are benefits and drawbacks that it’s important to believe ahead of deciding the place to place your cash. Here’s my record of SaveBetter execs and cons:

Execs:

- You’ll open an account in 3-5 mins.

- Get admission to investments from a couple of monetary establishments.

- Arrange your entire accounts from a unmarried dashboard.

- Simplified tax reporting with a unmarried 1099-INT record.

Cons:

- You can be making an investment with much less established FIs.

- No on-line invoice pay or checking products and services to be had.

- Restricted customer support is solely to be had between 9 AM and four PM EST.

SaveBetter Possible choices

As an internet market devoted to financial savings merchandise, SaveBetter is exclusive and has no direct competitor. That mentioned, different on-line banks are providing horny charges on high-interest financial savings accounts and CDs. Listed below are a few SaveBetter choices value taking into consideration.

Best friend Financial institution

Best friend is an online-only financial institution that still gives high-yield financial savings accounts and CDs. With a three.30% APY on the time of this writing, their financial savings account is fairly not up to what you’ll to find with SaveBetter. Nonetheless, it gives a lot of options you received’t to find somewhere else, like habitual transfers and financial savings buckets.

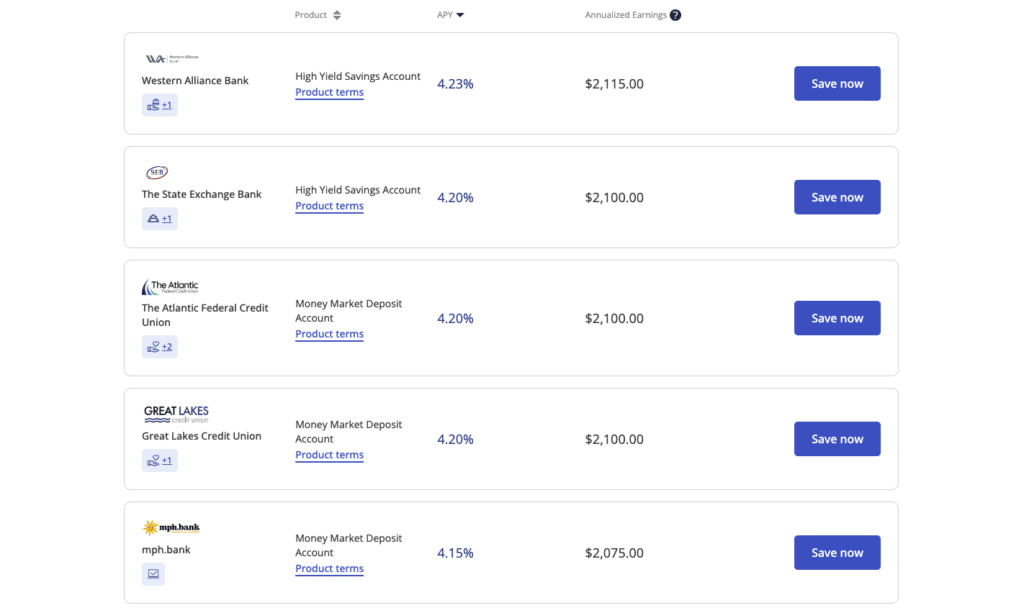

You additionally don’t have to fret a couple of minimal steadiness or repairs charges with an Best friend Financial institution financial savings account. Then again, should you’re in search of the absolute best go back on your cash, SaveBetter charges are upper. For instance, I discovered a Western Alliance Financial institution Financial savings Account with a 4.23% APY.

SoFi

SoFi is an internet private finance corporate and a financial institution that permits you to whole your monetary transactions in a single position. You’ll have a bank account, financial savings account, bank card, credit score ranking monitoring products and services, and quite a lot of different monetary merchandise beneath one umbrella.

SoFi is these days providing a financial savings account with a three.75% APY. You’ll do your entire banking in a single position, and also you’re assured to earn curiosity in your cash. With over 4 million customers, it’s transparent SoFi has grow to be a one-stop store for private finance for plenty of people.

SaveBetter FAQs

Since SaveBetter solely introduced in 2021, many buyers nonetheless aren’t conversant in the corporate. Listed below are the solutions to a few not unusual questions other people have about SaveBetter.

Sure. SaveBetter connects you with relied on monetary establishments. All the deposits at the platform are held at establishments which are federally insured.

SaveBetter these days doesn’t price consumers any charges for the usage of the platform. You’ll get started making an investment with as low as $1 with out being concerned about any hidden charges you in most cases to find with a banking account.

SaveBetter generates income through charging monetary establishments to marketplace merchandise to the platform’s consumers. Through charging the banks and credit score unions, SaveBetter can be offering consumers unfastened products and services and better charges.

When advertising to achieve new consumers, smaller, lesser identified monetary intuitions merely don’t have the monetary sources to compete with the extra established banks. To draw new consumers national, those banks and credit score unions be offering upper rates of interest to lure new consumers to sign up.

While you transfer your budget out of your exterior banking account, the budget move from the checking account to a custodial account with the establishment providing the financial savings product. A federally-insured banking establishment or credit score union at all times holds your cash.

When you do have to enroll in a credit score union to make use of its merchandise, SaveBetter guarantees that the method is fast, simple, and unfastened. Which means that SaveBetter consumers can make investments with a credit score union with out paying any club enrollment charges. You are going to at all times get admission to the monetary product in the course of the SaveBetter platform.

SaveBetter works with a number of banks and credit score unions. One of the crucial banks and credit score unions come with:

– Ponce Financial institution

– Nice Lakes Credit score Union

– Idabel Nationwide Financial institution

– American First Credit score Union

– Lemmata Financial savings Financial institution

– SkyOne Federal Credit score Union

– Sallie Mae Financial institution

– mph.financial institution

You’ll discover a record of banks and credit score unions and their merchandise at the SaveBetter Discover web page.

You’ll touch the SaveBetter customer support workforce Monday to Friday between 9 a.m. and four p.m. EST. Their phone quantity is (844-994-EARN). You’ll additionally ship an e-mail to [email protected].

SaveBetter Evaluation: Ultimate Ideas

In the event you’re in search of a spot to park your cash within the brief time period, you must be testing SaveBetter’s gives. On the very least, overview the goods to look if you’ll discover a appropriate product that meets your wishes. Financial savings accounts don’t be offering the go back attainable of long-term marketplace investments, however you’ll sleep smartly at night time understanding your cash’s protected.

Even if SaveBetter isn’t as established as one of the vital giant nationwide banks, they usually paintings with smaller monetary establishments, know that your cash will probably be secure with deposit insurance coverage whilst you earn a good go back.

Present SaveBetter Gives

I appeared in the course of the gives to search out the most efficient offers to be had at the SaveBetter platform. Listed below are some noteworthy gives on the time of writing:

Those are simply a number of the many gives to be had at the discover web page of SaveBetter. Each financial savings product has a $1 minimal funding if you wish to join.

SaveBetter Evaluation

Product Identify: SaveBetter

Product Description: SaveBetter is an aggregator of high-yielding financial savings accounts and CD merchandise. SaveBetter permits you to uncover and buy a couple of financial savings merchandise from other banks and credit score unions and arrange them from a unmarried dashboard.

Abstract

SaveBetter is an aggregator of high-yielding financial savings accounts and CD merchandise. SaveBetter permits you to uncover and buy a couple of financial savings merchandise from other banks and credit score unions and arrange them from a unmarried dashboard.

- Value and Charges

- Buyer Carrier

- Consumer Enjoy

- Product Choices

Execs

- You’ll open an account in 3-5 mins.

- Get admission to investments from a couple of monetary establishments.

- Arrange your entire accounts from a unmarried dashboard.

- Simplified tax reporting with a unmarried 1099-INT record.

Cons

- You can be making an investment with much less established FIs.

- No on-line invoice pay or checking products and services to be had.

- Restricted customer support is solely to be had between 9 AM and four PM EST.