A 3-paycheque month can provide you with a monetary head get started

There are many techniques to play that additional cost

Opinions and suggestions are independent and merchandise are independently decided on. Postmedia might earn an associate fee from purchases made via hyperlinks in this web page.

Article content material

Through Sandra Fry

Commercial 2

Article content material

Do you reside paycheque to paycheque? For individuals who receives a commission biweekly, March may well be a month while you get an “additional” paycheque. For lots of, the additional pay this month merely is helping finish the month within the black, and the money is quickly spent. However as a credits counsellor, I really like to indicate what a distinction this bonus cheque could make in a consumer’s quest to get on best in their finances.

Article content material

Right here’s why March 2023 might be your month to make the adjustments you’ve all the time sought after to make in your spending, budgeting and general cash control gadget.

Maximum people have an concept about which expenses want to receives a commission each time we get a paycheque. Even with no formal finances or paycheque plan, we generally tend to divvy up our bills right through the month. If we’ve two giant bills, akin to a automobile mortgage and hire, we use the primary paycheque to pay our automobile mortgage and the second one is going to hire in order that it’s no longer past due. Software expenses, bank cards and different bills receives a commission when there’s sufficient cash left over to do this.

Article content material

Commercial 3

Article content material

However what occurs when there’s more cash? That’s when the cheap is much more vital than standard. With no finances, we don’t know the place we stand. Will we spend the additional money on a splurge, pay a invoice off solely, save for an expense that comes up yearly, or simply go away it in our checking account in case we want it? There’s no proper or incorrect resolution, however relying in your targets and monetary state of affairs, some concepts for the additional money will determine higher for you in the end than others.

In case you’re managing your whole expenses and bills smartly, believe the use of the additional paycheque to pay one invoice off totally. In case you don’t have a invoice that you’ll be able to repay solely, pay your smallest invoice down up to conceivable. Psychologically, it may be extraordinarily motivating to knock one invoice off your listing and redirect the cost cash to every other invoice. This is known as the snowball manner and it’s one of the crucial quickest techniques to get debt paid down speedy.

Commercial 4

Article content material

Bank card charges

In case you’re suffering and having bother managing your tasks, an additional paycheque may get you out of a troublesome spot with considered one of your expenses. That you must ask your credit-card corporate to scale back your rate of interest or waive a rate if you are making an important cost via a particular time. In case you’re in the back of in your electrical energy invoice and face disconnection, an additional cost would possibly prevent that added bother and expense. In case you’re in the back of in your hire or charges for kid care, the additional cash may well be simply what you wish to have.

Alternatively, ahead of making a decision the place to make use of it, define your whole tasks to resolve the place an additional bit of money permit you to probably the most.

An additional paycheque could also be a good way to jumpstart a financial savings account. Whether or not it’s for presents, an annual holiday, new glasses or your emergency fund, it will get more uncomplicated so as to add to a financial savings account when there’s already a forged get started on deposit.

Commercial 5

Article content material

In case you pay your loan semi-monthly, that involves 24 bills each and every yr. Alternatively, for those who obtain your paycheques biweekly and make your loan bills biweekly as smartly, that involves 26 bills each and every yr. When you gained’t have as a lot “additional” cash to be had in a three-paycheque month, you are going to save time and passion in your loan. It’s a method of increasing your bills to pay your own home off sooner. Discuss together with your loan lender for those who’d like to be told extra about the way to boost up your bills.

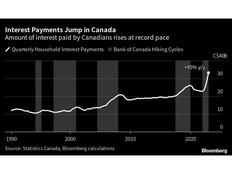

You’ll be able to additionally boost up your bills on bank cards, traces of credits, overdrafts and a few loans. An additional cost a couple of occasions a yr, or shedding part of your tax refund down on a debt, way you pay much less passion in the end. With rates of interest as top as they’re at the moment, any financial savings you’ll be able to to find simply makes it that a lot more uncomplicated to repay what you owe.

Commercial 6

Article content material

-

Prime rates of interest imply you do not want to be past due for those who pay source of revenue tax via instalments

-

Fewer Canadians have emergency financial savings readily available, riding down financial sentiment: ballot

-

Borrowing towards existence insurance coverage is usually a distinctive supply of money — if you’ll be able to do it

In spite of everything, search for techniques to succeed in your targets. Possibly you wish to have to compensate for some house repairs or automobile upkeep. In case you’ve by no means had the cash to open a tax-free financial savings account, now chances are you’ll. Topping up your registered retirement financial savings plan (RRSP) may assist get you an source of revenue tax refund subsequent yr, which you need to reinvest into your RRSP once more. Many Canadians use this technique to verify they aren’t hit with a wonder source of revenue tax invoice, but additionally to stay making an investment of their RRSP when their finances is tight.

Commercial 7

Article content material

If March isn’t your month to ruin the cycle of residing paycheque to paycheque, June may well be. In case you document your taxes on time, you’ll expectantly have your refund via then, too. Mix any refund you get with the additional paycheque, and you need to have a large sum to get again heading in the right direction and provides your self a blank monetary slate.

Sandra Fry is a Winnipeg-based credits counsellor at Credit score Counselling Society, a non-profit group that has helped Canadians set up debt for greater than 26 years.

_____________________________________________________________

In case you like this tale, join the FP Investor E-newsletter.

_____________________________________________________________

Feedback

Postmedia is dedicated to keeping up a full of life however civil discussion board for dialogue and inspire all readers to proportion their perspectives on our articles. Feedback might take as much as an hour for moderation ahead of showing at the web site. We ask you to stay your feedback related and respectful. We have now enabled electronic mail notifications—you are going to now obtain an electronic mail for those who obtain a answer in your remark, there’s an replace to a remark thread you observe or if a person you observe feedback. Discuss with our Neighborhood Pointers for more info and main points on the way to modify your electronic mail settings.

Sign up for the Dialog